PERIODICAL THESES

Position: RESEARCH > PERIODICAL THESES > Content

The Principal-Agent Problem under the National Overall Planning of Pension Insurance: Is the Vertical Management of Handling Institutions the Key to Cracking?

Author: Upload Time:2024-06-27 Views: Go Back

Professor Wang Zengwen, deputy director of the Social Security Research Center of Wuhan University, and doctoral candidates Yao Jin and Peng Haorong published a paper entitled "The Principal-Agent Problem under the National Overall Planning of Pension Insurance: Is the Vertical Management of Handling Institutions the Key to Cracking?" in the 7th issue of China Soft Science in 2024. Dissertation. The full text is now forwarded and shared with readers.

【author】Wang Zengwen,Yao Jin,Peng Haorong

【Published journals】《中国软科学》

【Journal level】CSSCI

【Publication time】Issue 7,2024

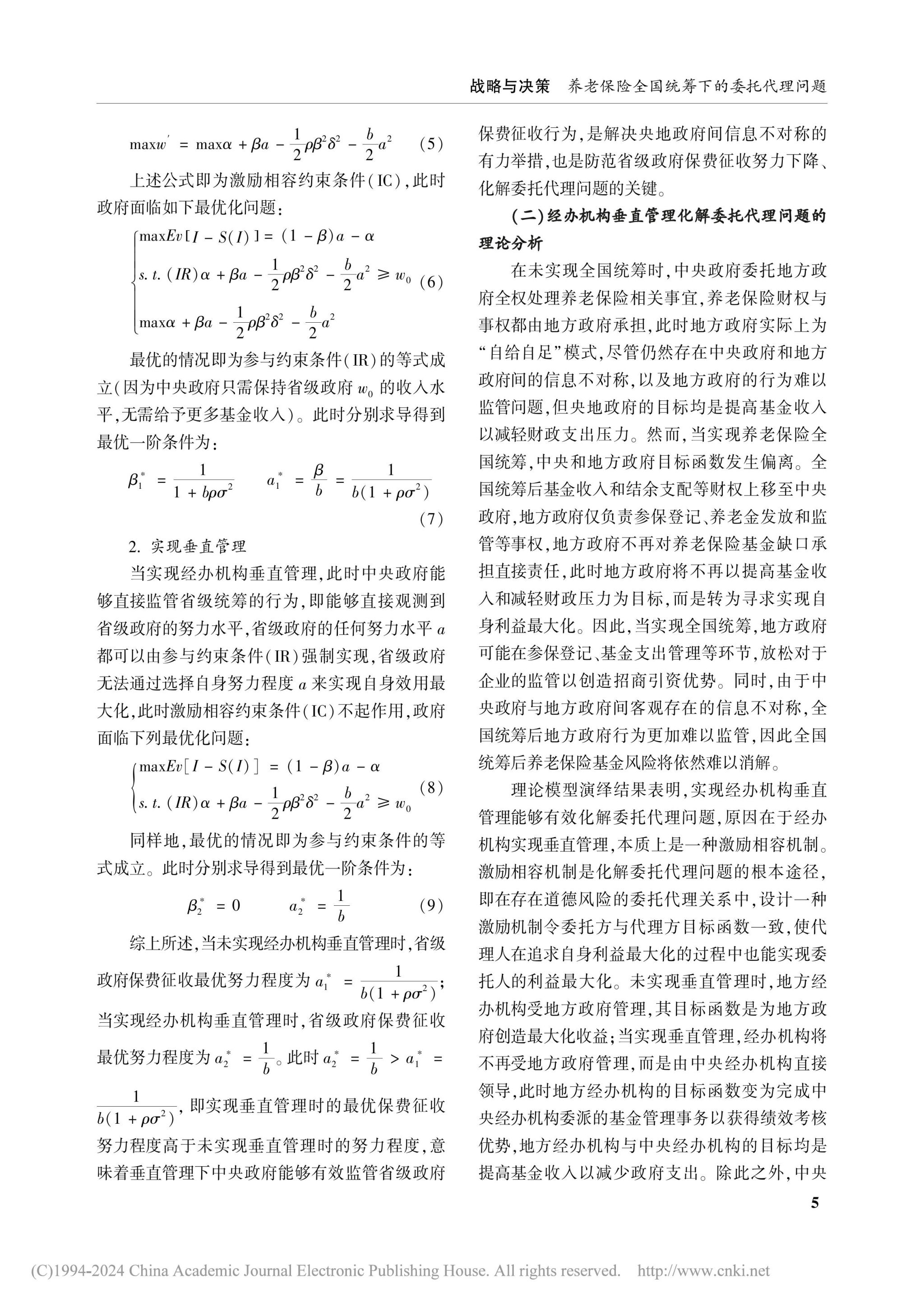

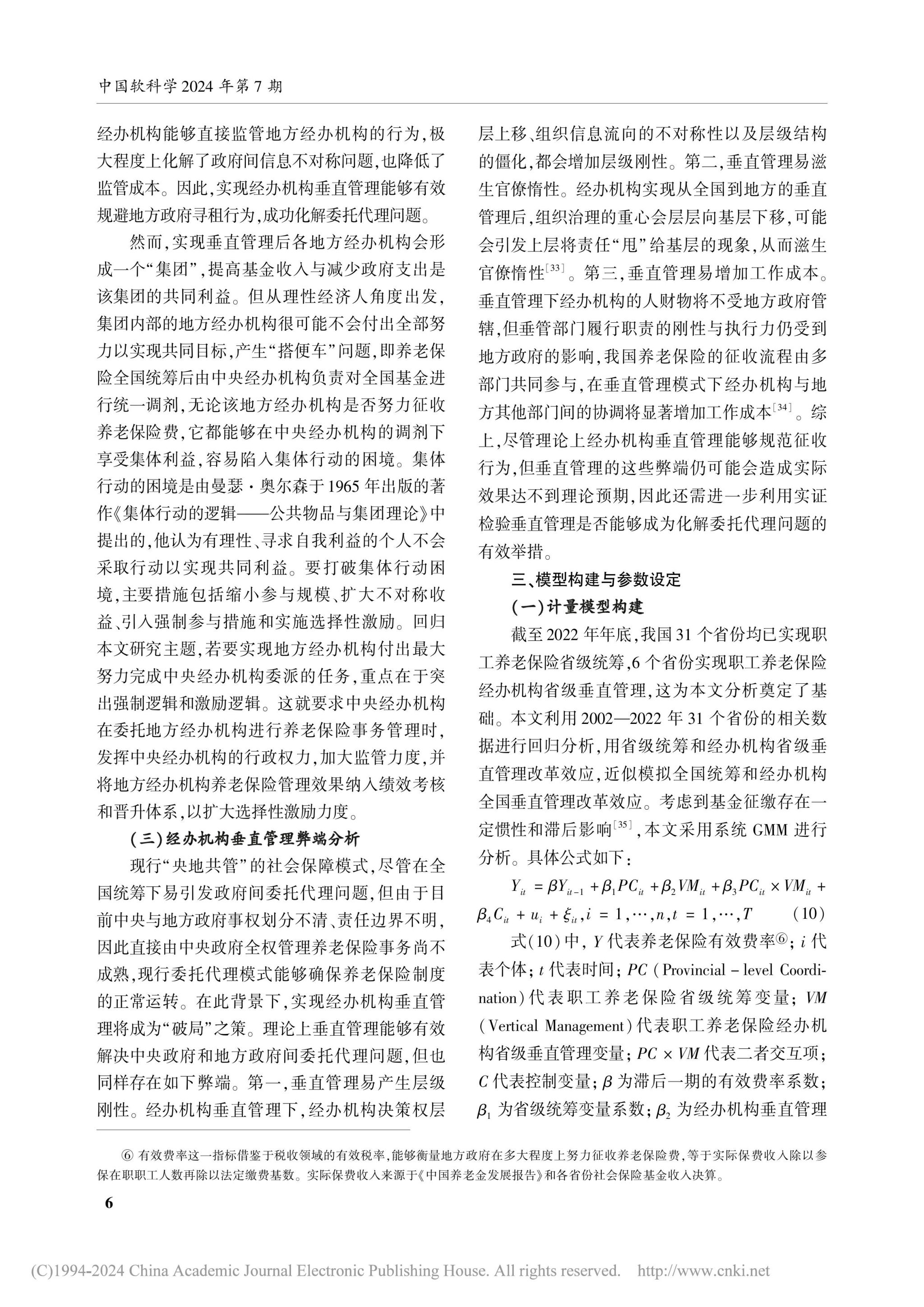

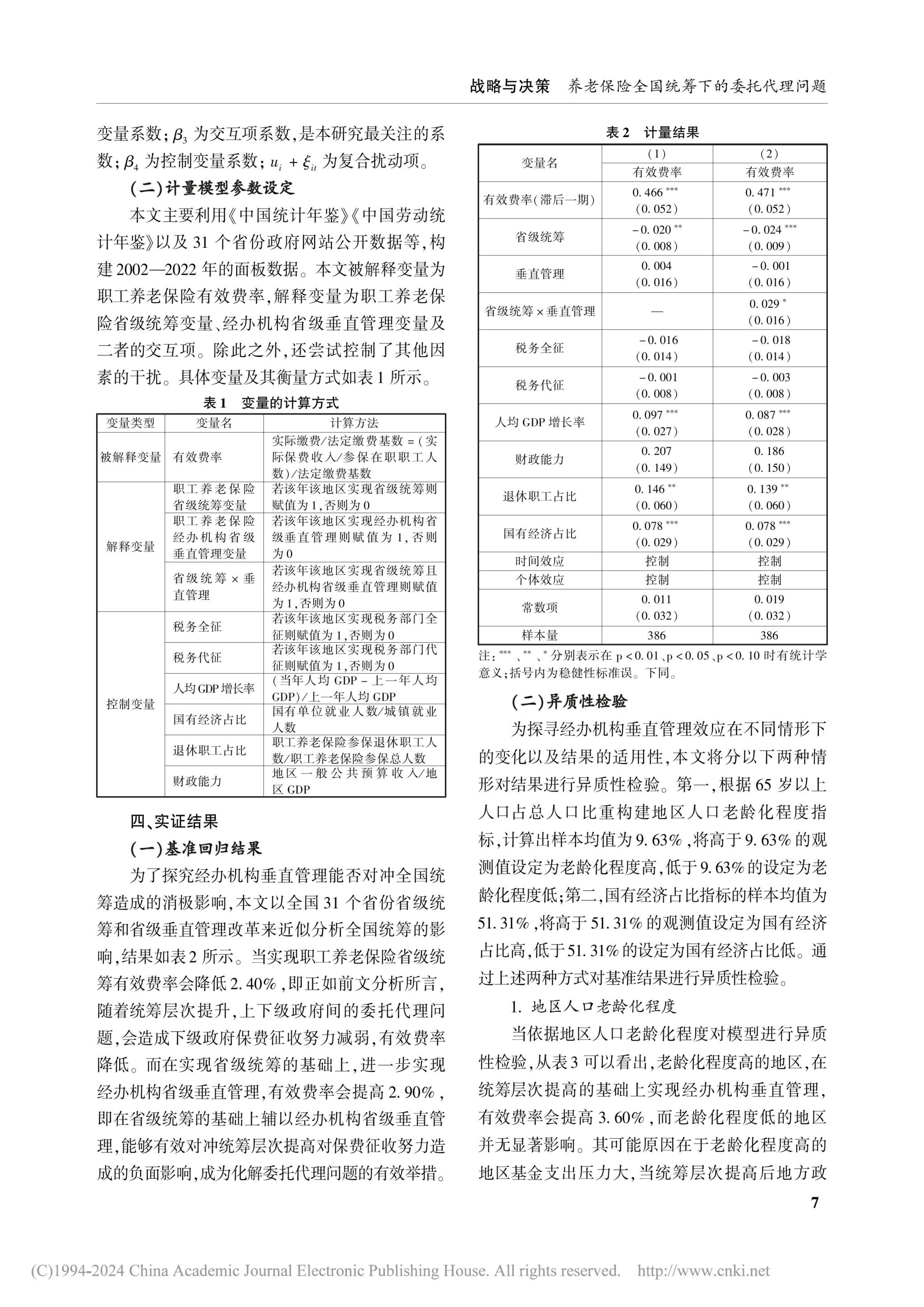

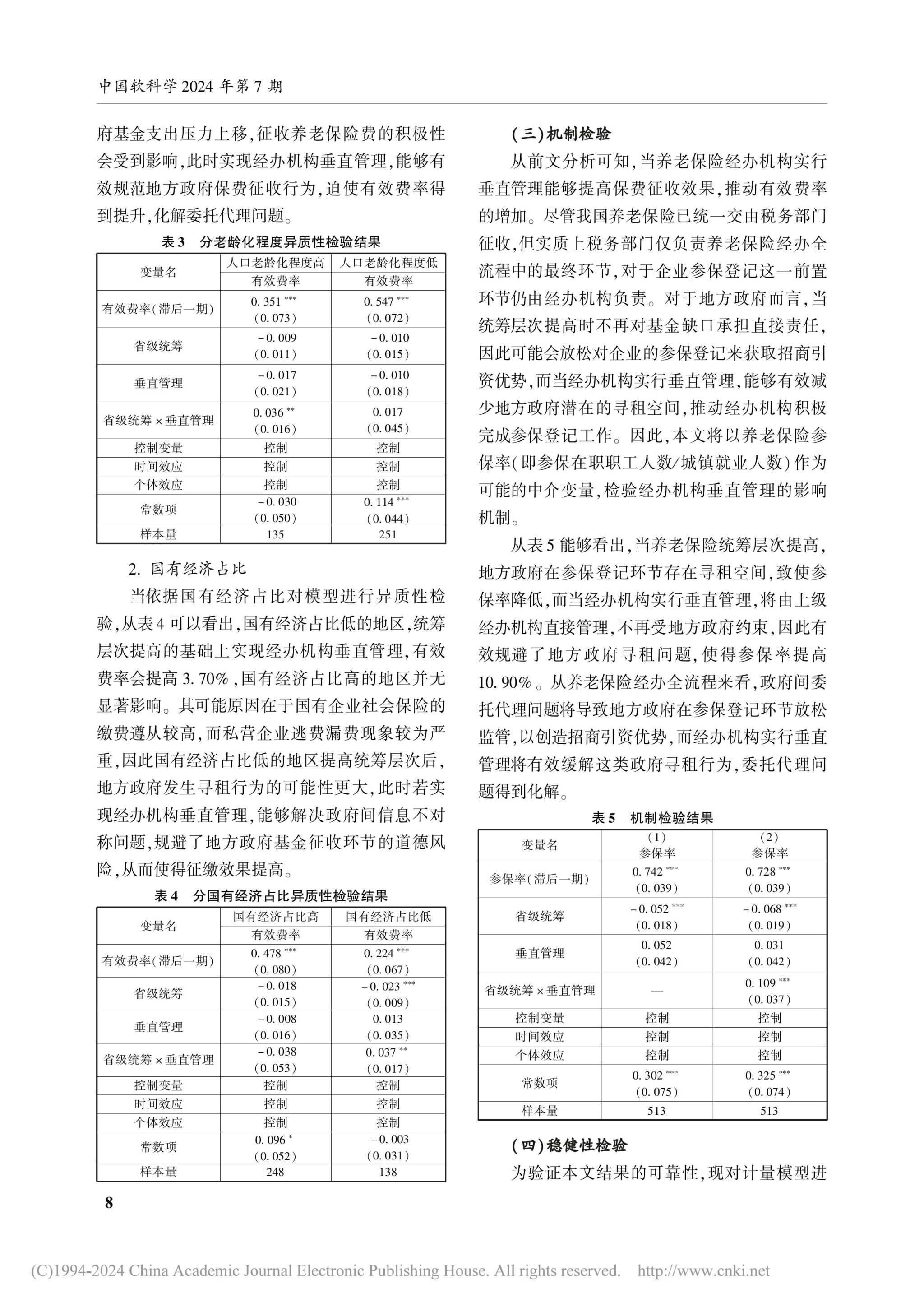

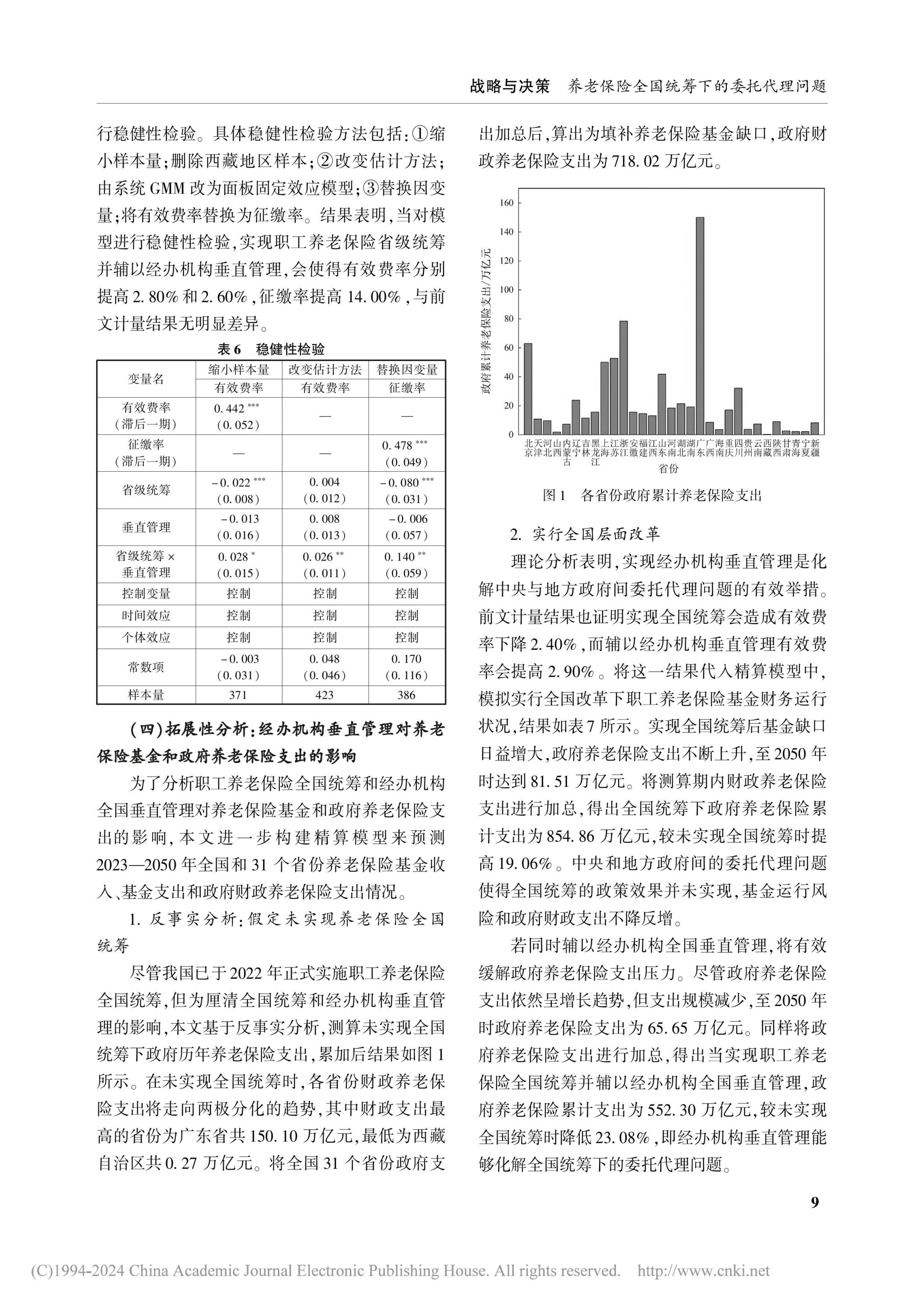

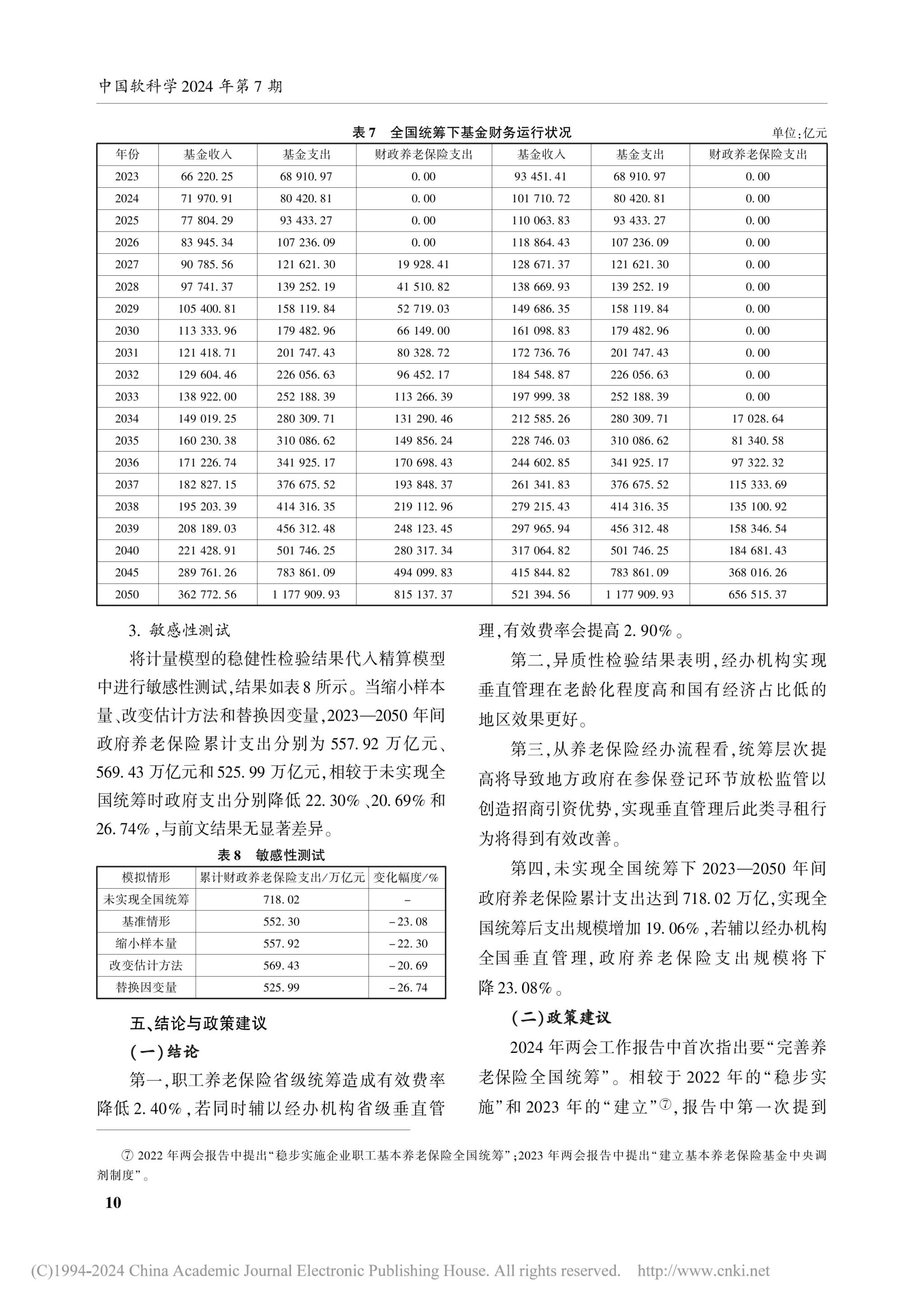

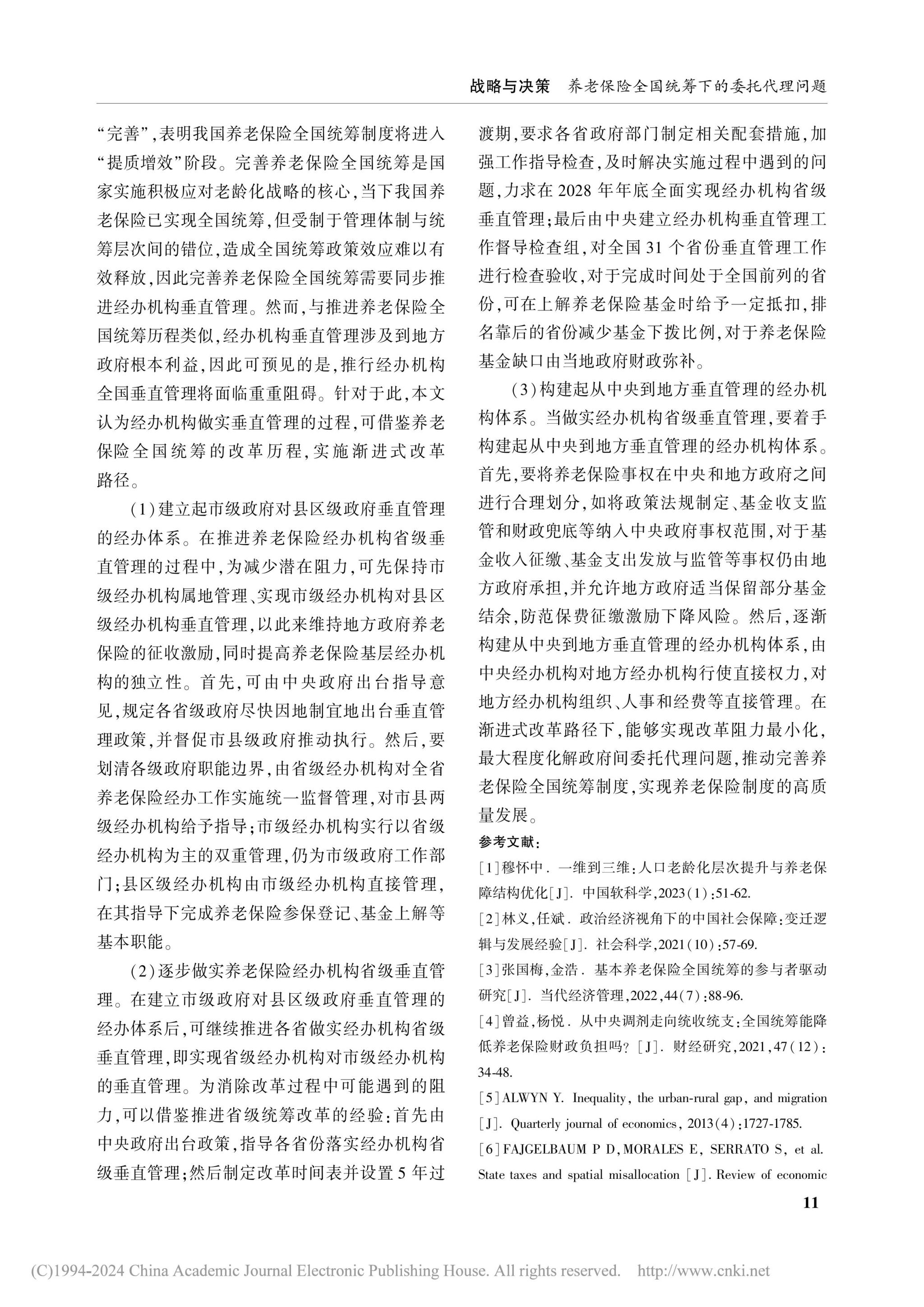

【Abstract】In 2022, China's employee pension insurance will officially achieve national overall planning. However, subject to the current "central and local co-management" social security model, the national overall planning is easy to lead to the problem of entrustment and agency between the central and local governments, which is not conducive to the smooth realization of the national overall planning goal. In this context, can the national vertical management of the handling agency successfully resolve the principal-agent problem? Using the provincial reform to approximate the national reform, the measurement and actuarial models are constructed, and it is found that: first, the effective rate of employee pension insurance is reduced by 2.40% due to the provincial overall planning, and the effective rate will be increased by 2.90% if it is supplemented by the provincial vertical management of the handling agency; Second, the results of the heterogeneity test show that the vertical management of the handling agency is more effective in areas with a high degree of aging and a low proportion of the state-owned economy. Third, from the perspective of the pension insurance handling process, the improvement of the overall level will lead to the relaxation of supervision by local governments in the insurance registration process to create investment advantages, and such rent-seeking behaviors will be effectively improved after the realization of vertical management; Fourth, the total expenditure of government pension insurance tickets from 2023 to 2050 will reach 718.02 trillion under the national overall planning, and the scale of fiscal expenditure will increase by 19.06% after the national overall planning, and the scale of government pension insurance expenditure will decrease by 23.08% if supplemented by the national vertical management of the agency. To sum up, in order to ensure the effective release of the effect of the national overall policy, it is believed that a gradual reform path should be adopted, that is, the management system of vertical management of the municipal government to the county and district governments should be established first, then the provincial vertical management of the pension insurance agency should be implemented, and finally the vertical management system from the central to the local government should be built, so as to promote the high-quality development of the employee pension insurance system.

【Keywords】national overall planning; vertical management; effective rates; Fiscal pension insurance expenditures

【Funds】National Social Science Foundation of China, "Research on Improving the Work System and Security System for Veterans" (21AZD072); Humanities and Social Sciences Planning Fund of the Ministry of Education, "Research on the Policy Framework for Solving the Problem of Low Fertility under the Imbalance between Childcare Cost and Family Income" (21YJA630093);

WeChat public account

Sponsor Unit:武汉大学社会保障研究中心 Address:湖北省武汉市武昌区八一路299号 Postal Code:430072 Tel:027-68752238/027-68755887 E-mail:csss@whu.edu.cn