PERIODICAL THESES

Position: RESEARCH > PERIODICAL THESES > Content

The National People's Congress photocopied materials reproduces the full text of center's paper "Calculation and Analysis of the Contribution Level of Long-term Care Insurance under the Pay-as-You-Go System"

Author: Upload Time:2024-05-09 Views: Go Back

Associate Professor Xue Huiyuan, deputy director of the Social Security Research Center of Wuhan University, and Wu Xinyun, master degree candidate, published a paper entitled "Calculation and Analysis of Long-term Care Insurance Contribution Level under the Pay-As-You-Go System" published in the 11th issue of China Medical Insurance in 2023, which was reprinted in full in the 3rd issue of Social Security System in 2024. The full text is now forwarded and shared with readers.

【author】Xue Huiyuan,Wu Xinyun

【Original source】《中国医疗保险》Issue 11,2023

【Reprinted journals】《社会保障制度》

【Reprint time】Issue 3,2024

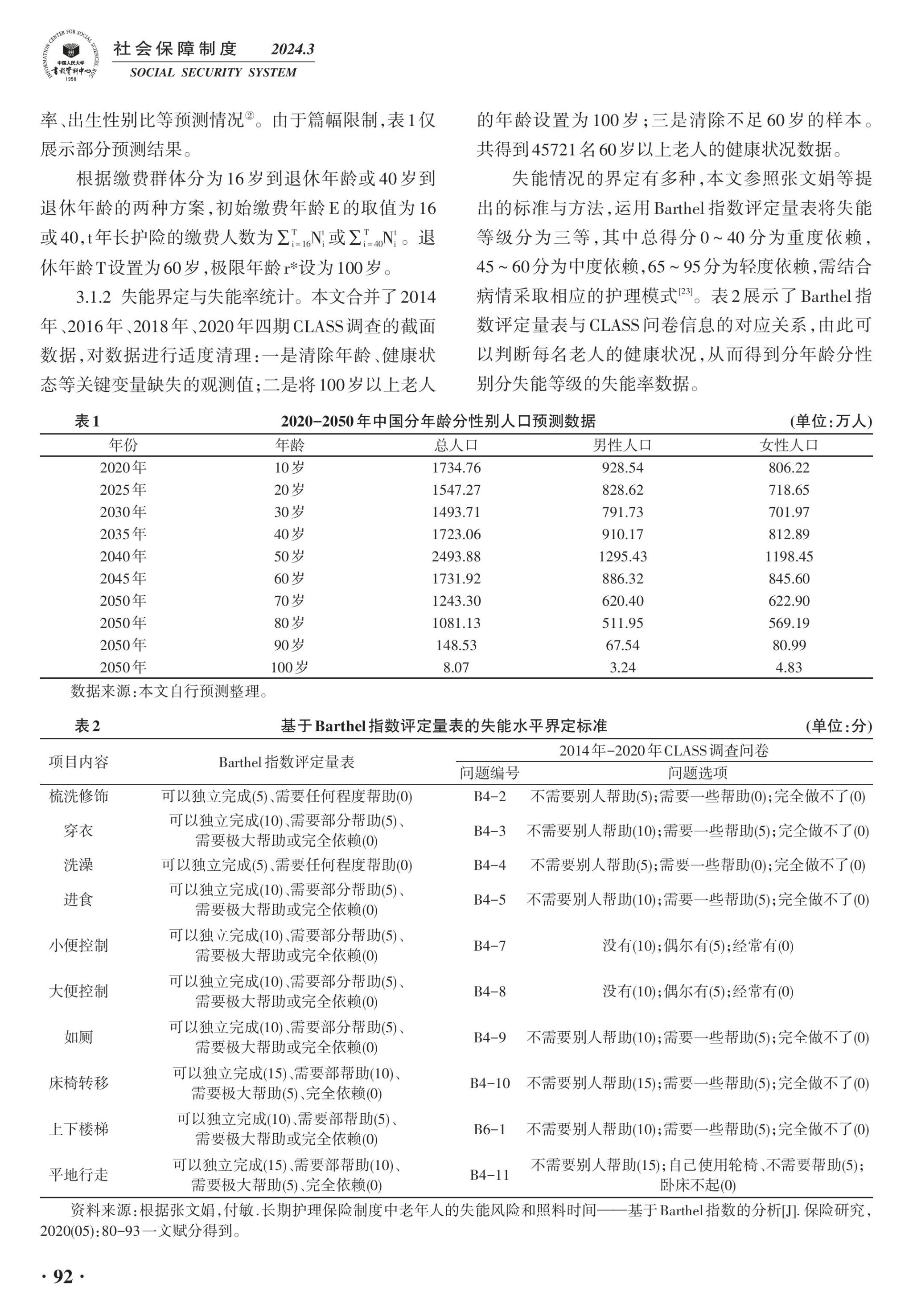

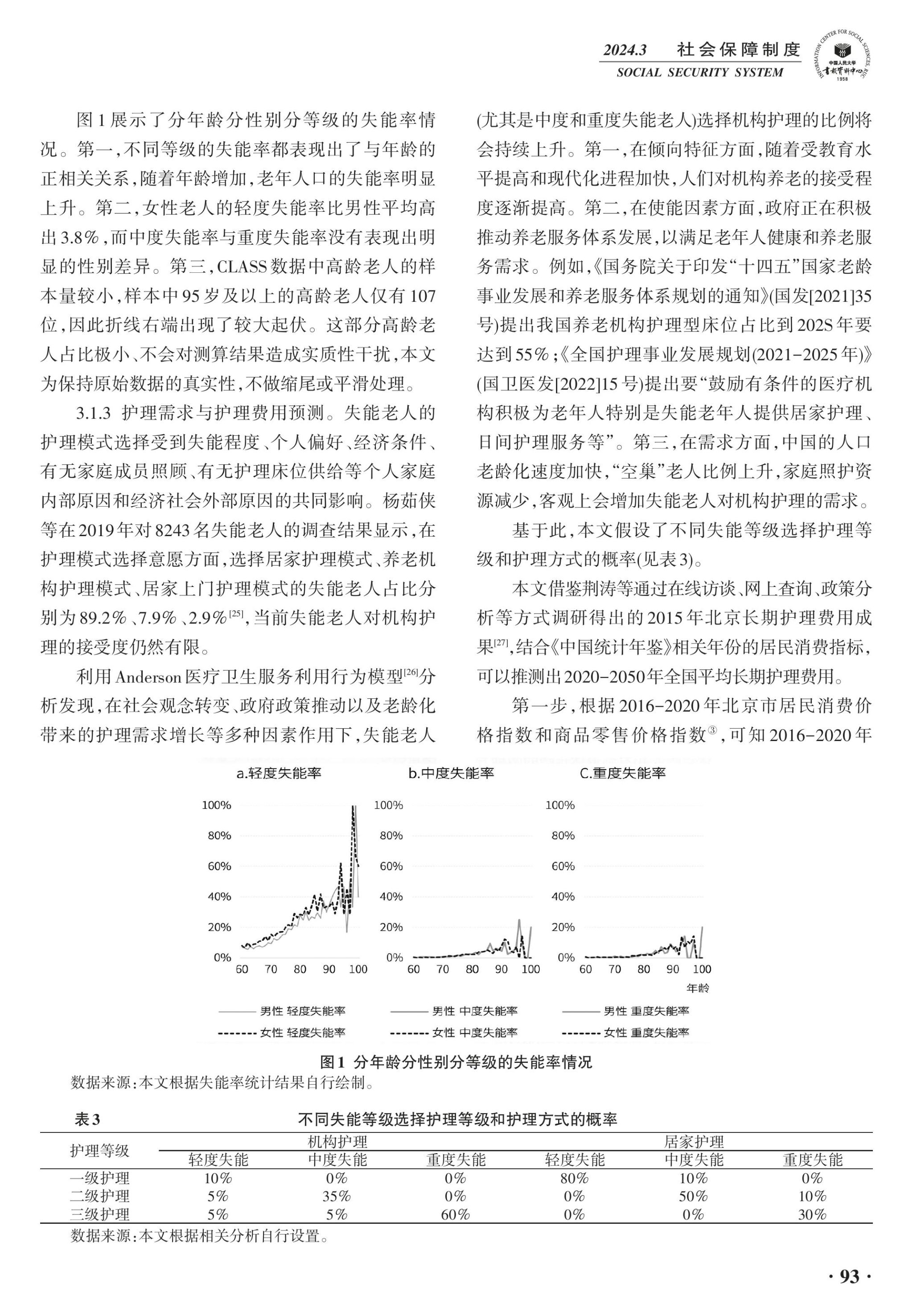

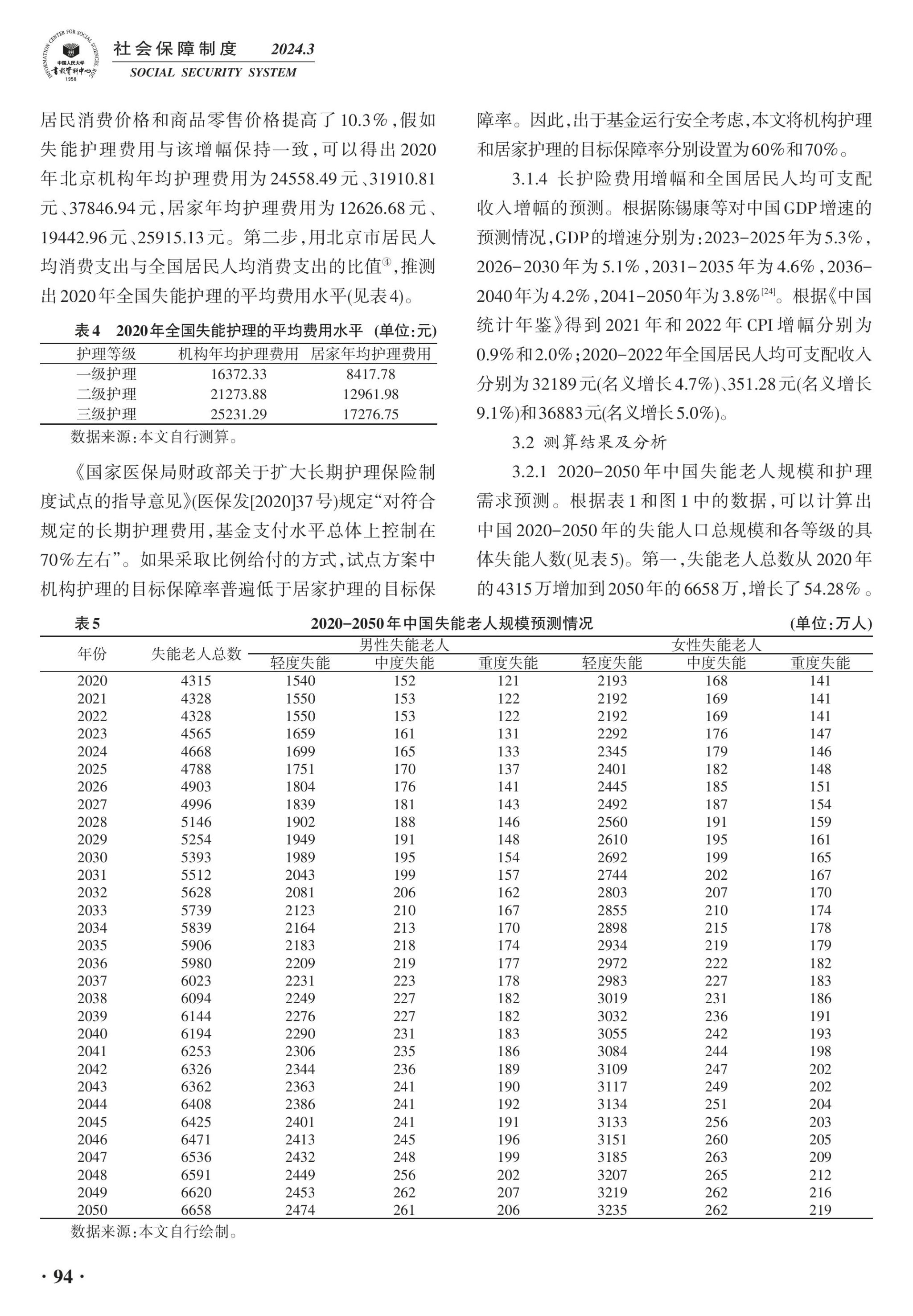

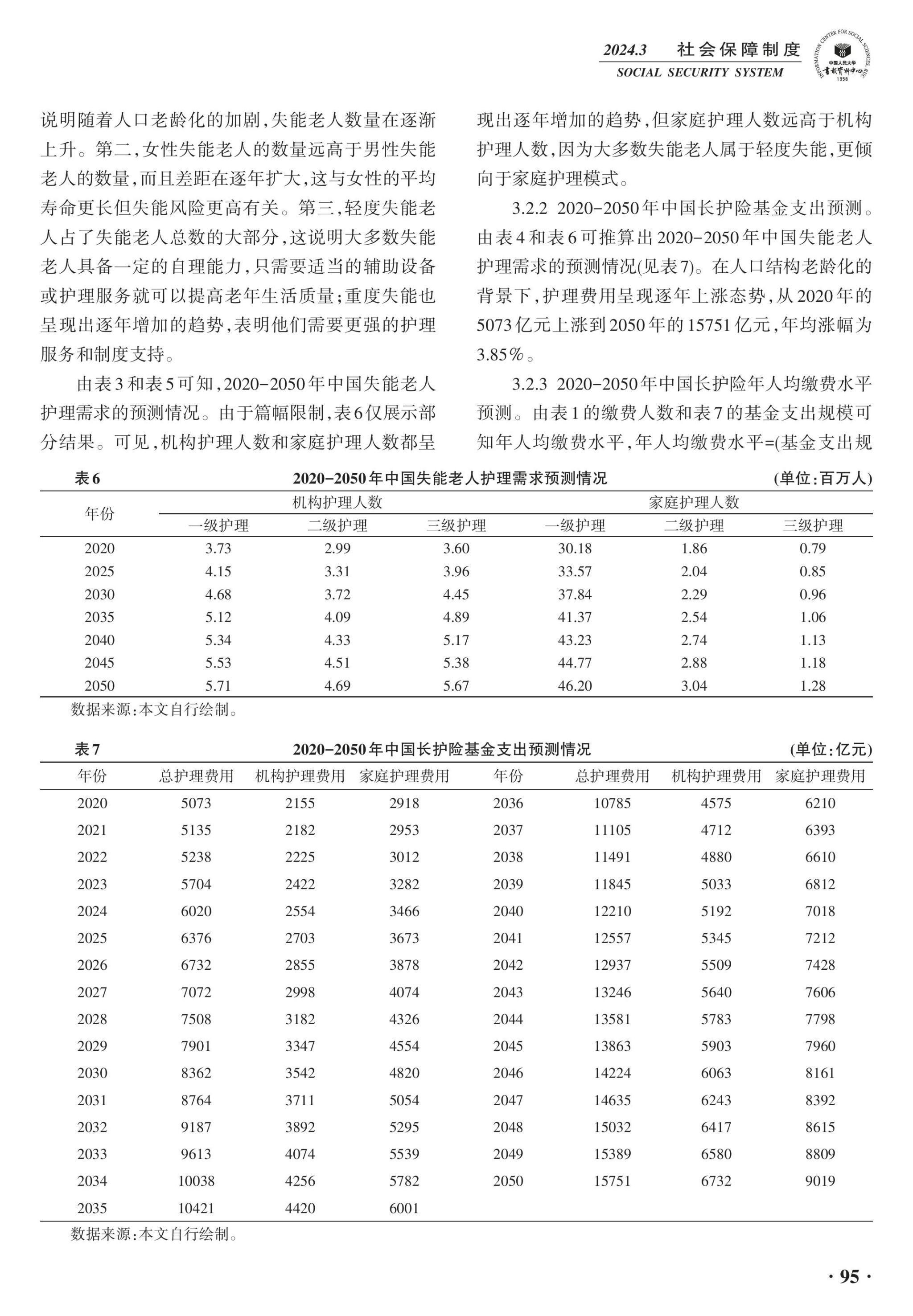

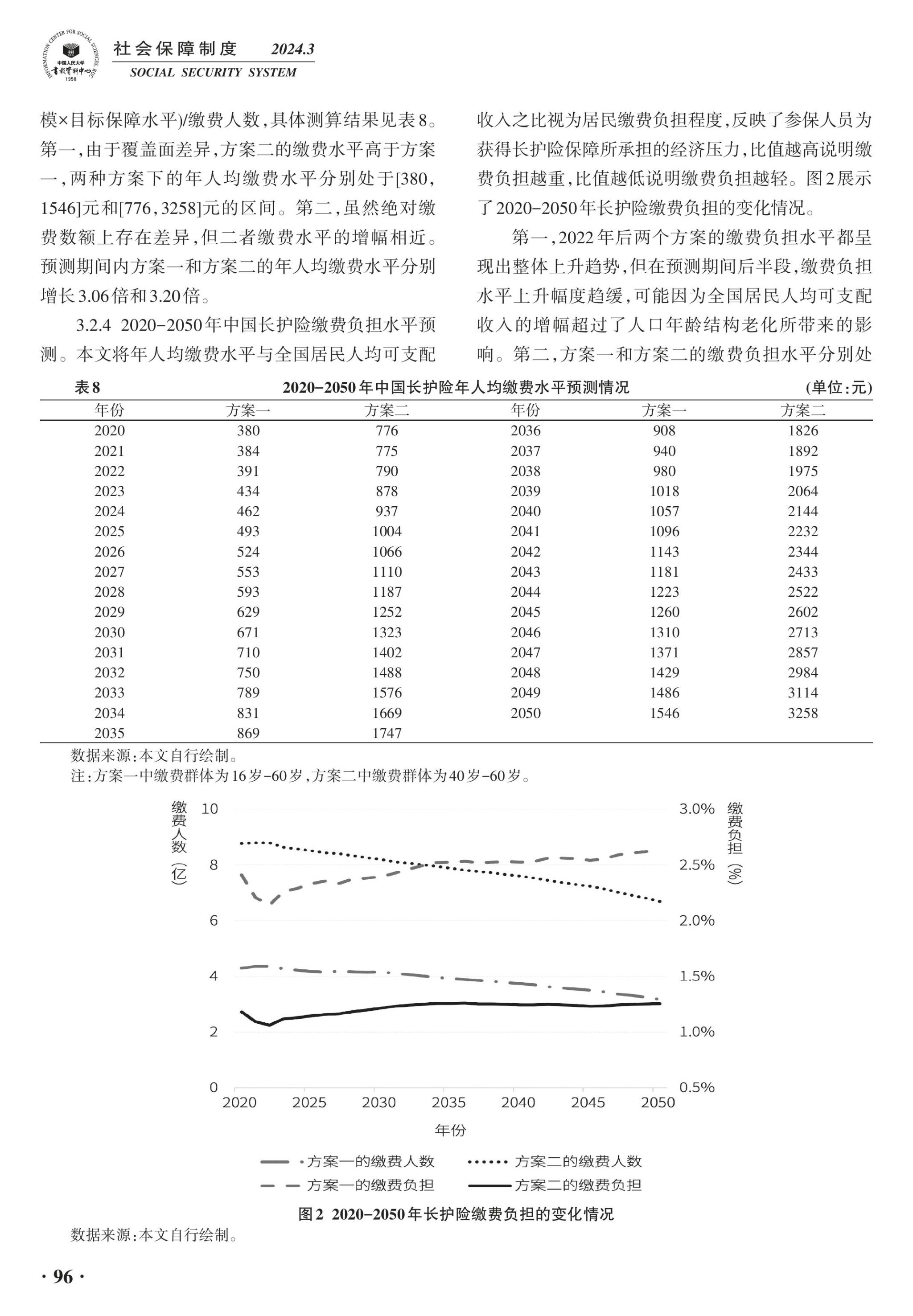

【Abstract】This paper argues that the pay-as-you-go system may be the future institutional direction of long-term care insurance in China, which has the advantages of social risk sharing and intergenerational equity, but also faces the potential risk of financial unsustainability. This paper uses the cross-sectional data of the fourth phase of CLASS from 2014 to 2020 and the Barthel index rating scale to calculate the disability rate of the elderly population by age and gender level, uses the population prediction software PADIS-INT to predict the scale, structure and change trend of the future Chinese population, and finally calculates the annual per capita contribution level and contribution burden level of China's long-term care insurance from 2020 to 2050 based on the fund balance principle. The results show that in the two schemes of 16-60 years old and 40-60 years old, the annual per capita payment level is in the range of [380,1546] yuan and [776,3258] yuan, respectively, and the payment burden level is in the range of [1.06%, 1.26%] and [2.14%, 2.64%], respectively. This indicates that the contribution burden of long-term care insurance is at an appropriate level, which provides favorable conditions for expanding coverage and increasing willingness to participate in insurance.

【Keywords】long-term care insurance; pay-as-you-go system; the level of contributions; Actuarial Balance; Long-term forecasting

【Funds】Humanities and Social Science Research Planning Fund of the Ministry of Education, "Research on the Effect Evaluation and Optimization Path of Long-term Care Insurance Pilot Policy Based on Counterfactual Analysis" (22YJA630101).

WeChat public account

Sponsor Unit:武汉大学社会保障研究中心 Address:湖北省武汉市武昌区八一路299号 Postal Code:430072 Tel:027-68752238/027-68755887 E-mail:csss@whu.edu.cn