PERIODICAL THESES

Position: RESEARCH > PERIODICAL THESES > Content

Overspending, Fund Pressure and Financial Burden of Employee Pension Insurance Personal Account: 2024~2050 - Based on the Actuarial Analysis of Representative Individuals and the Fund as a Whole

Author: Upload Time:2024-07-04 Views: Go Back

Associate Professor Xue Huiyuan, deputy director of the Social Security Research Center of Wuhan University, and Wu Xinyun, a master degree candidate, published a paper entitled "Overspending, Fund Pressure and Financial Burden of Employees' Pension Insurance Personal Accounts: 2024~2050 - Actuarial Analysis Based on Representative Individuals and Funds as a Whole" in the 5th issue of Insurance Research in 2024. The full text is now forwarded and shared with readers.

【author】Xue Huiyuan,Wu Xinyun

【Published journals】《保险研究》

【Journal level】CSSCI

【Publication time】Issue 5,2024

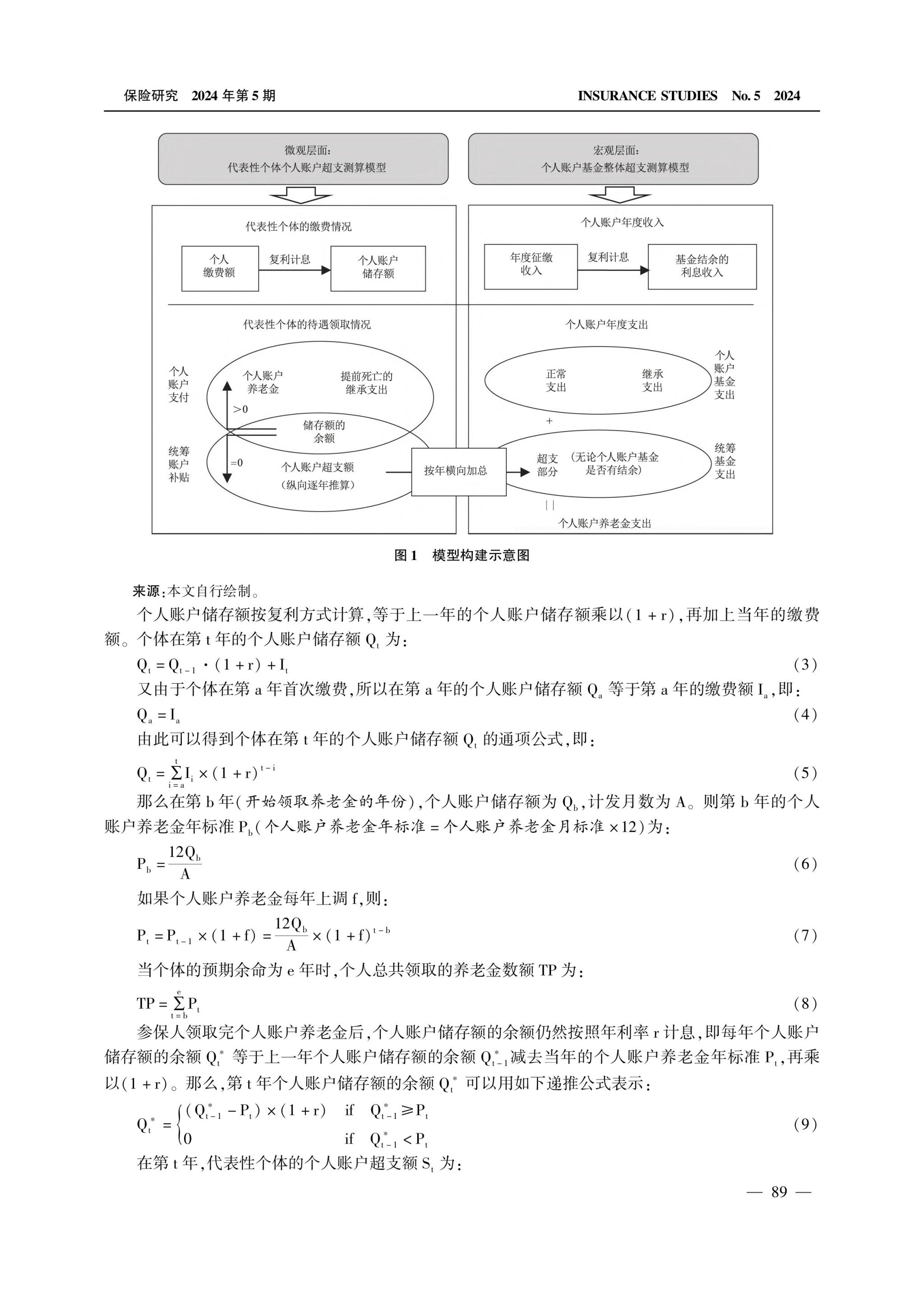

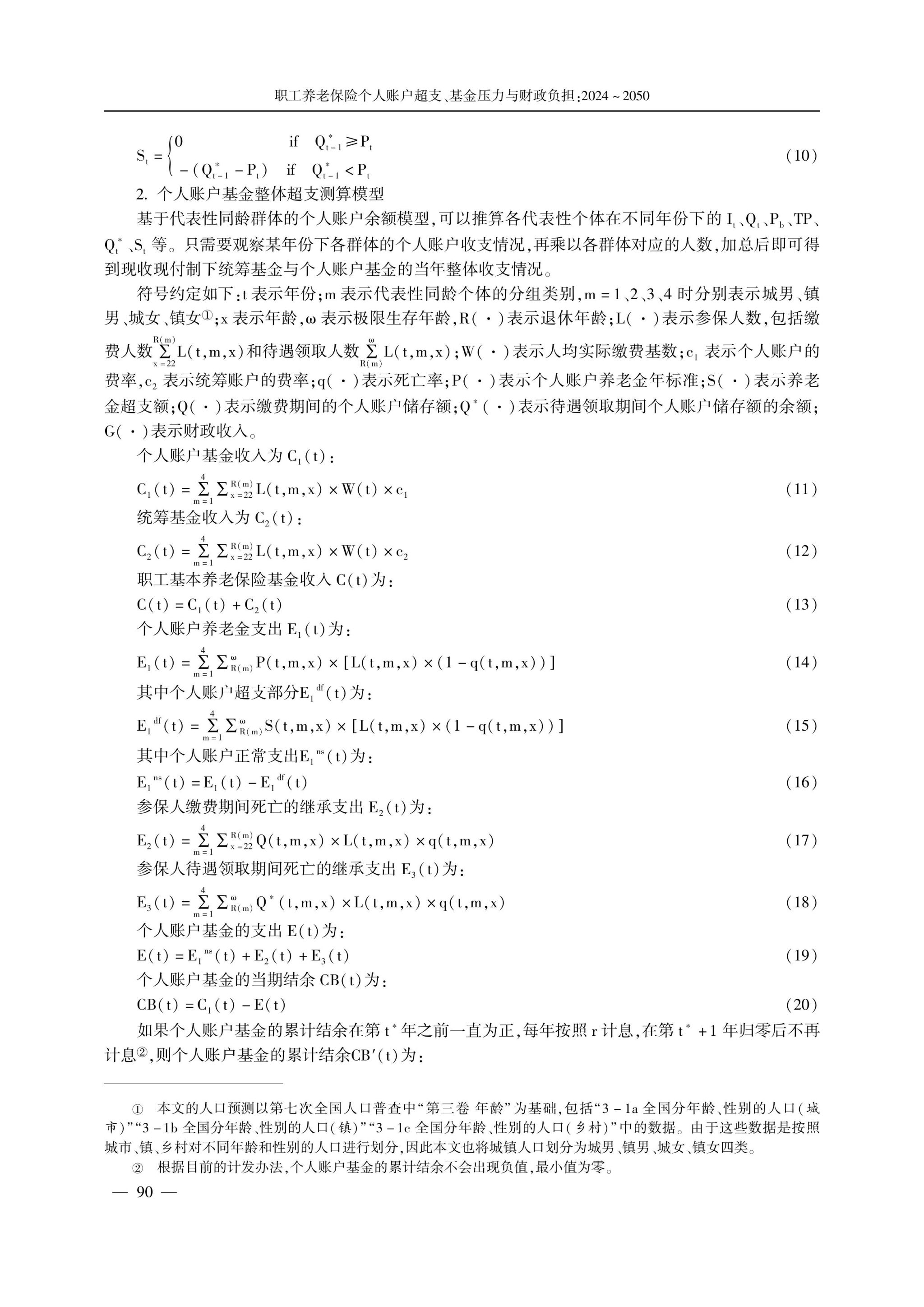

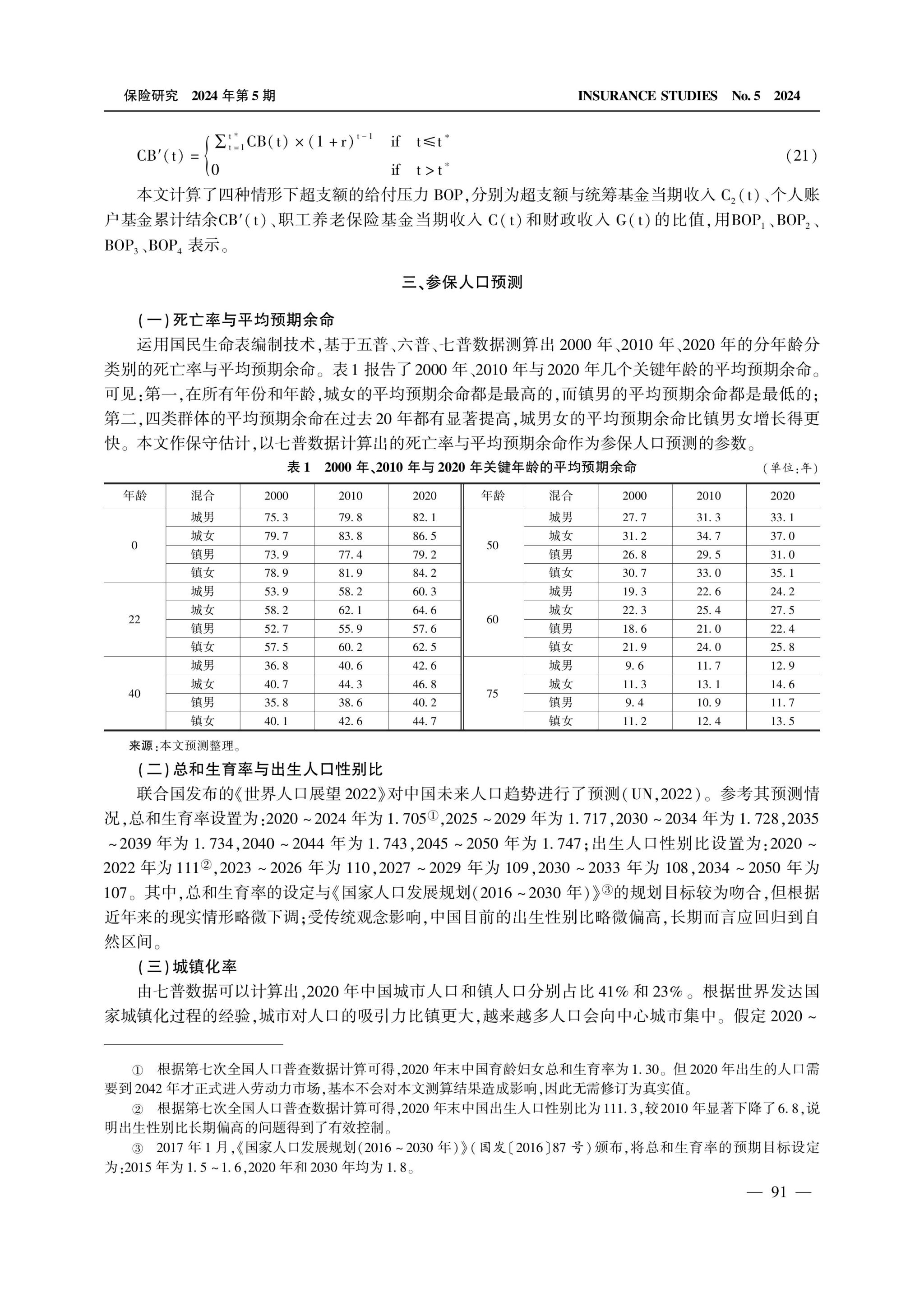

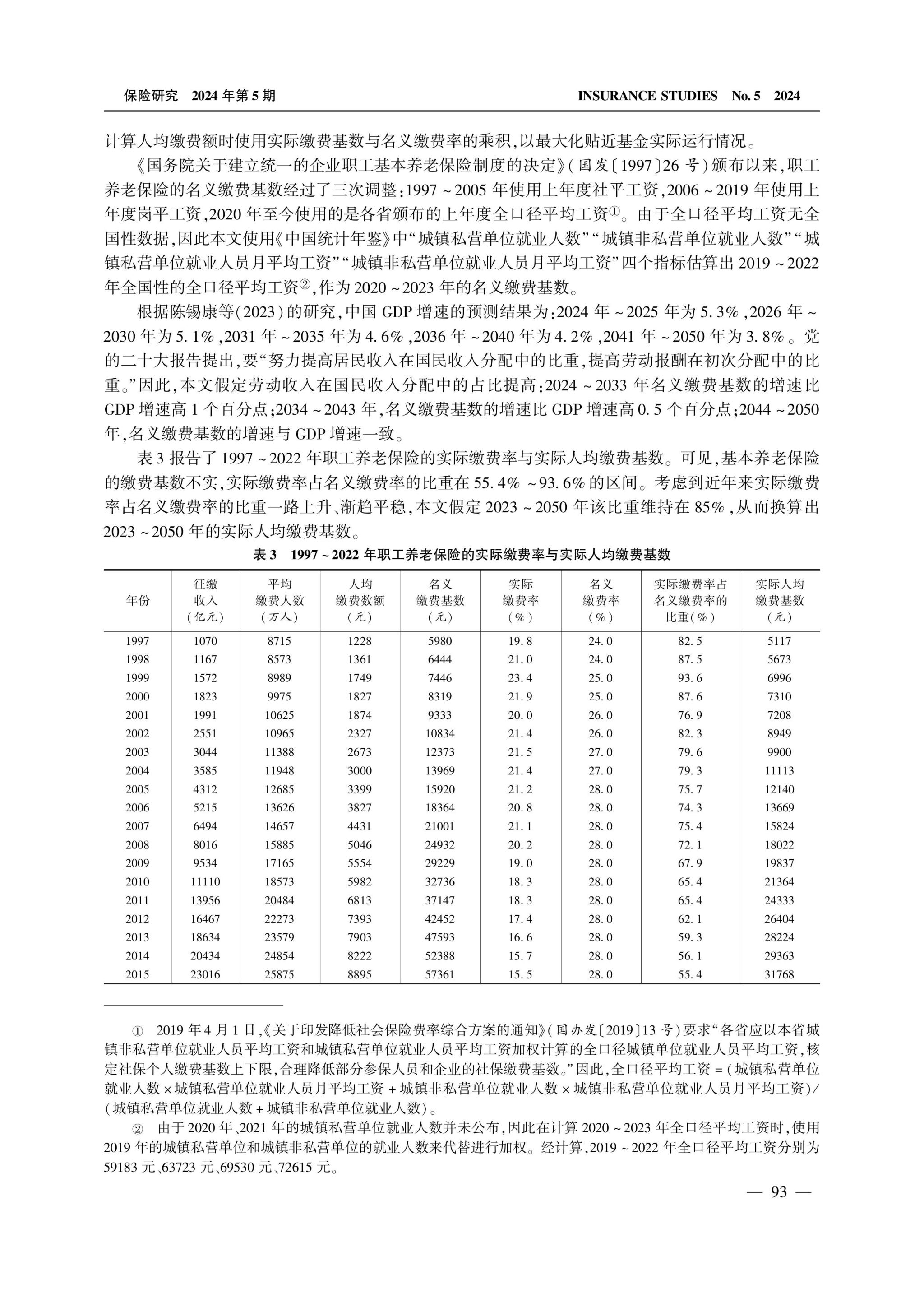

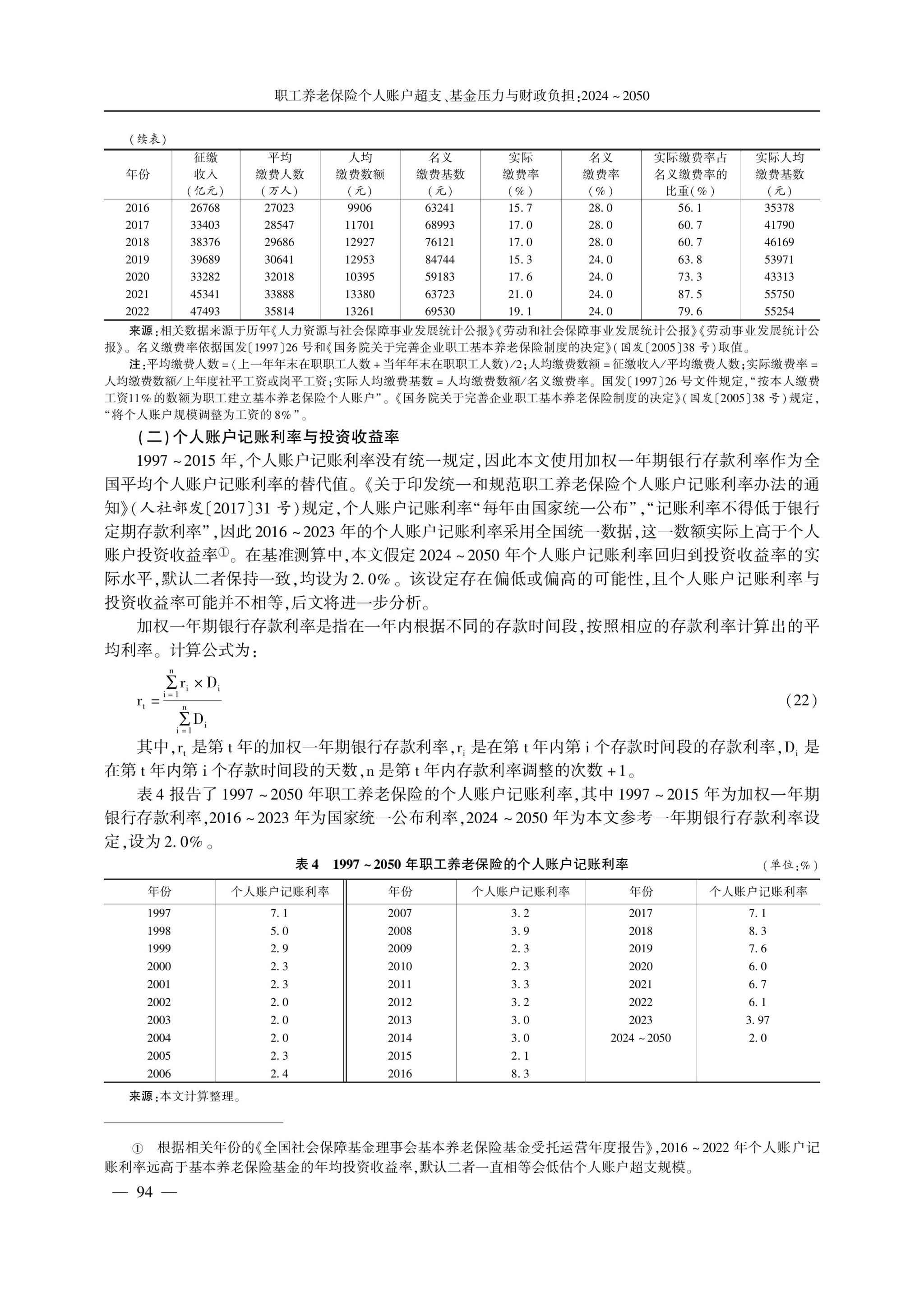

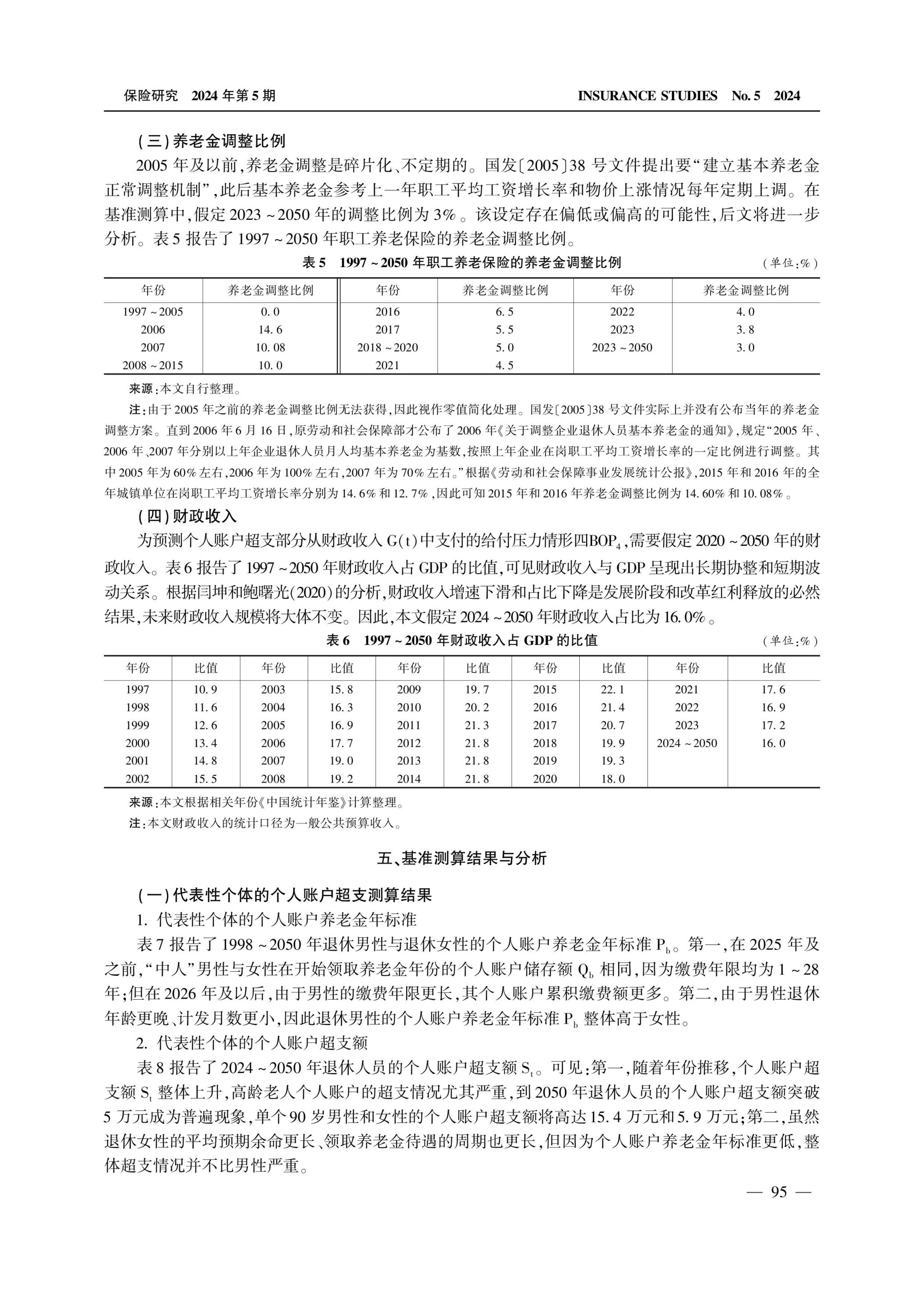

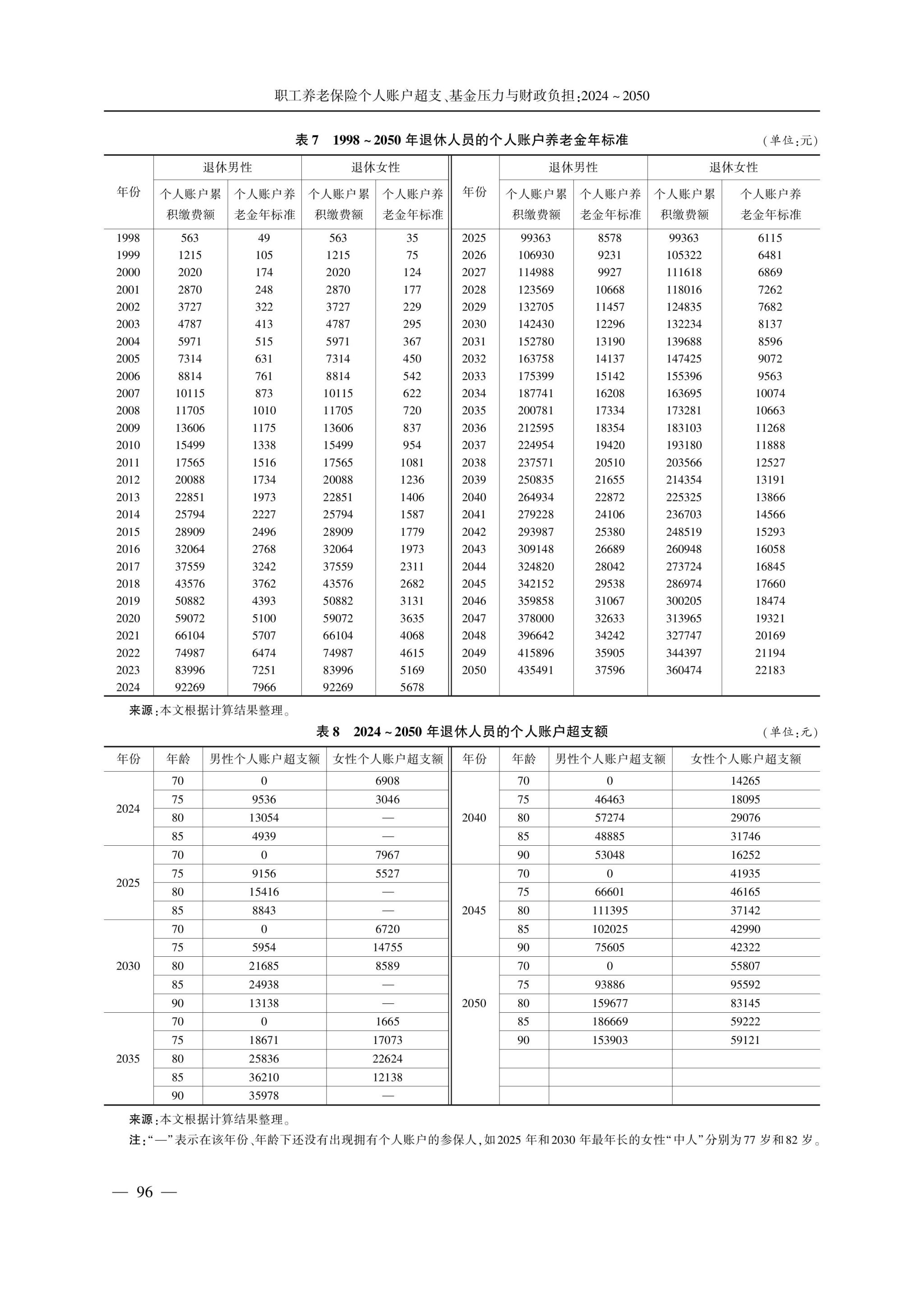

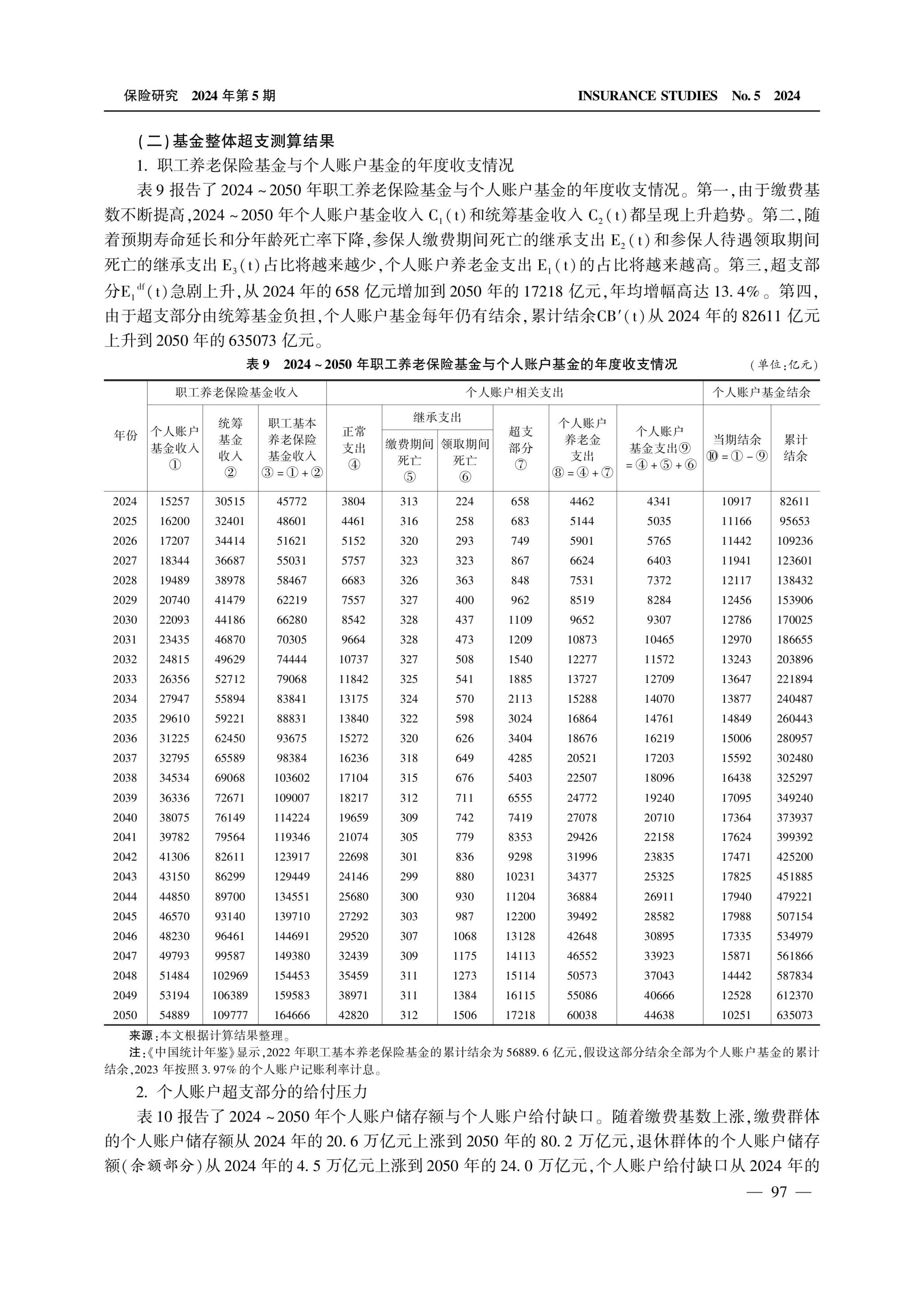

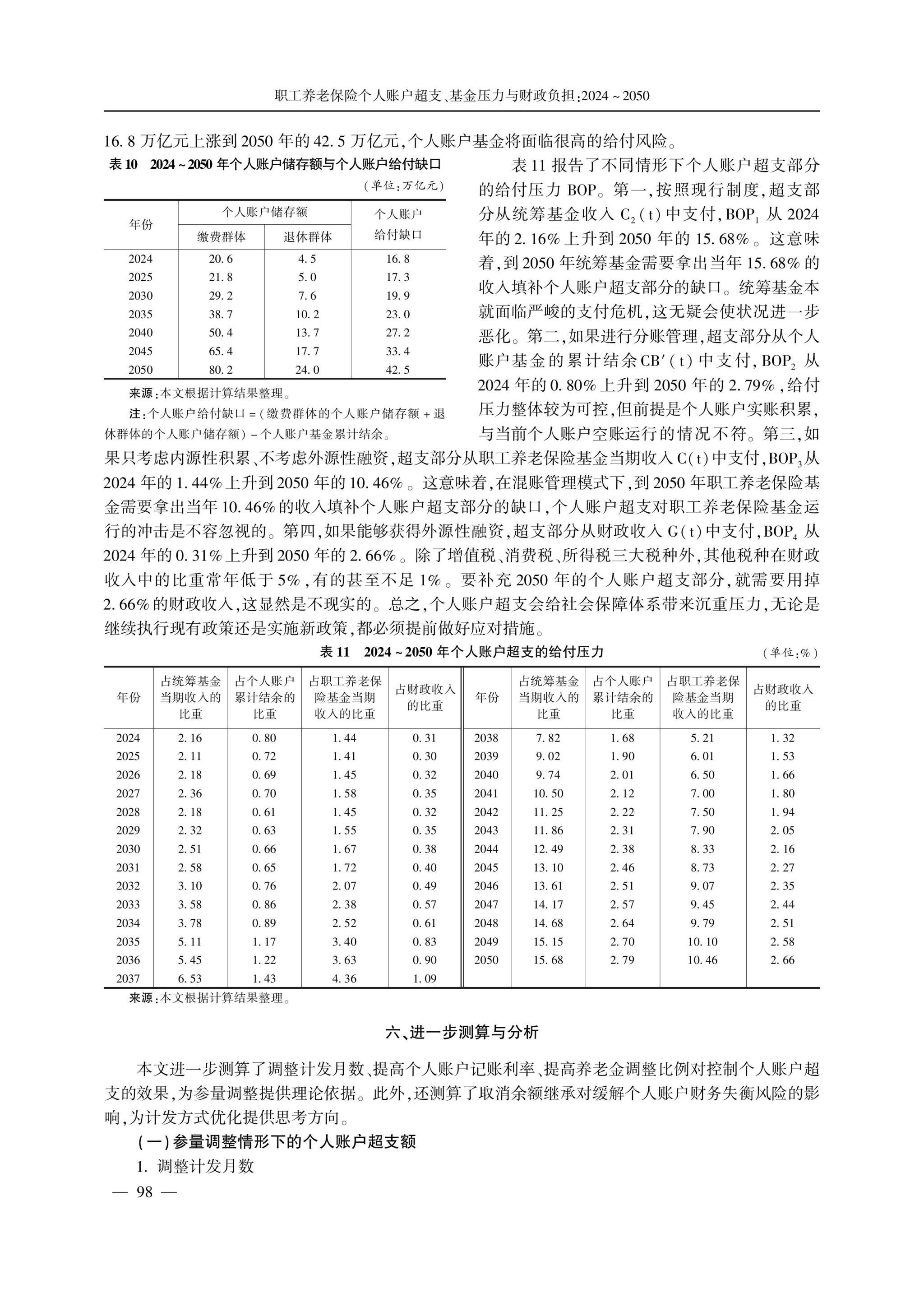

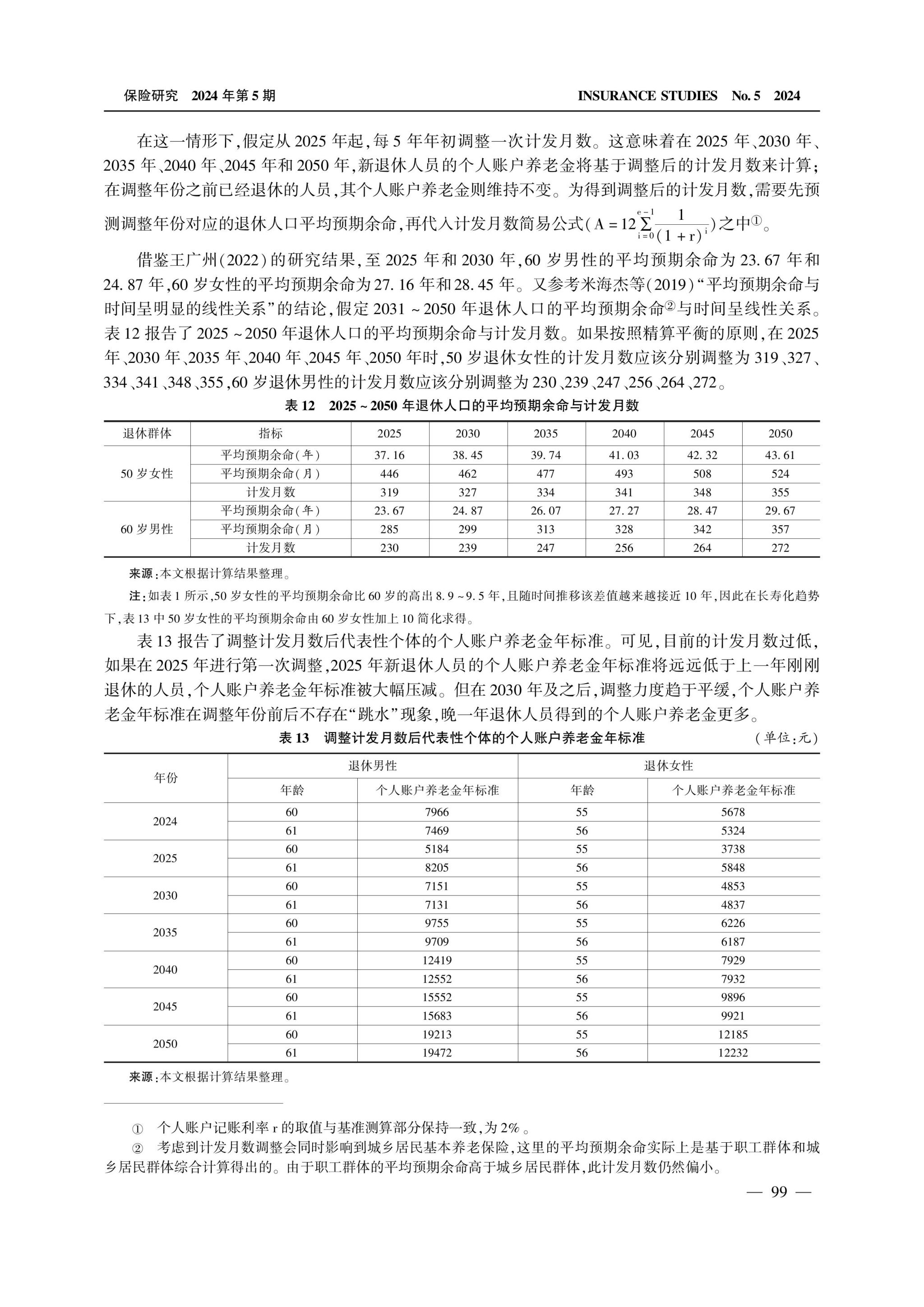

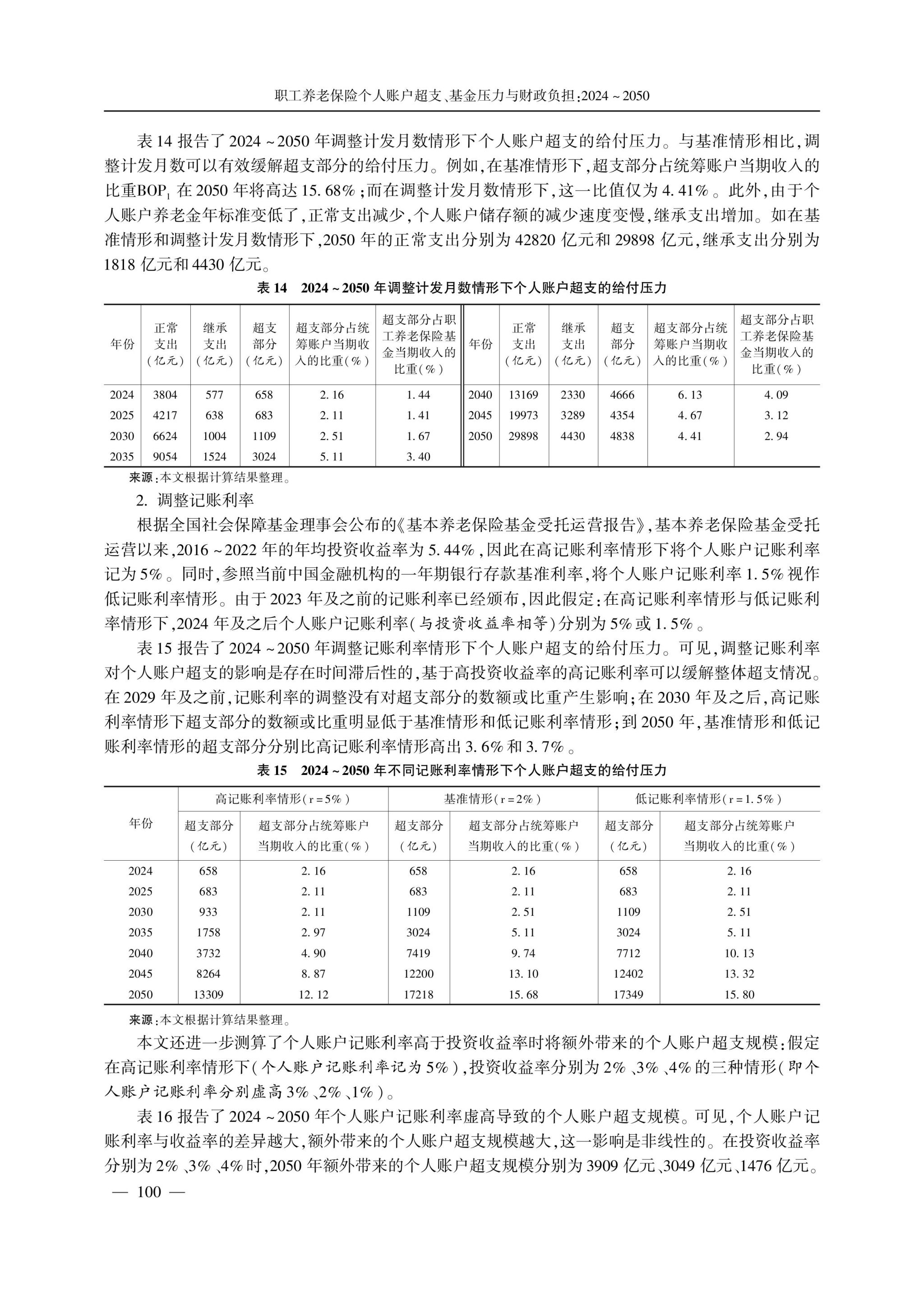

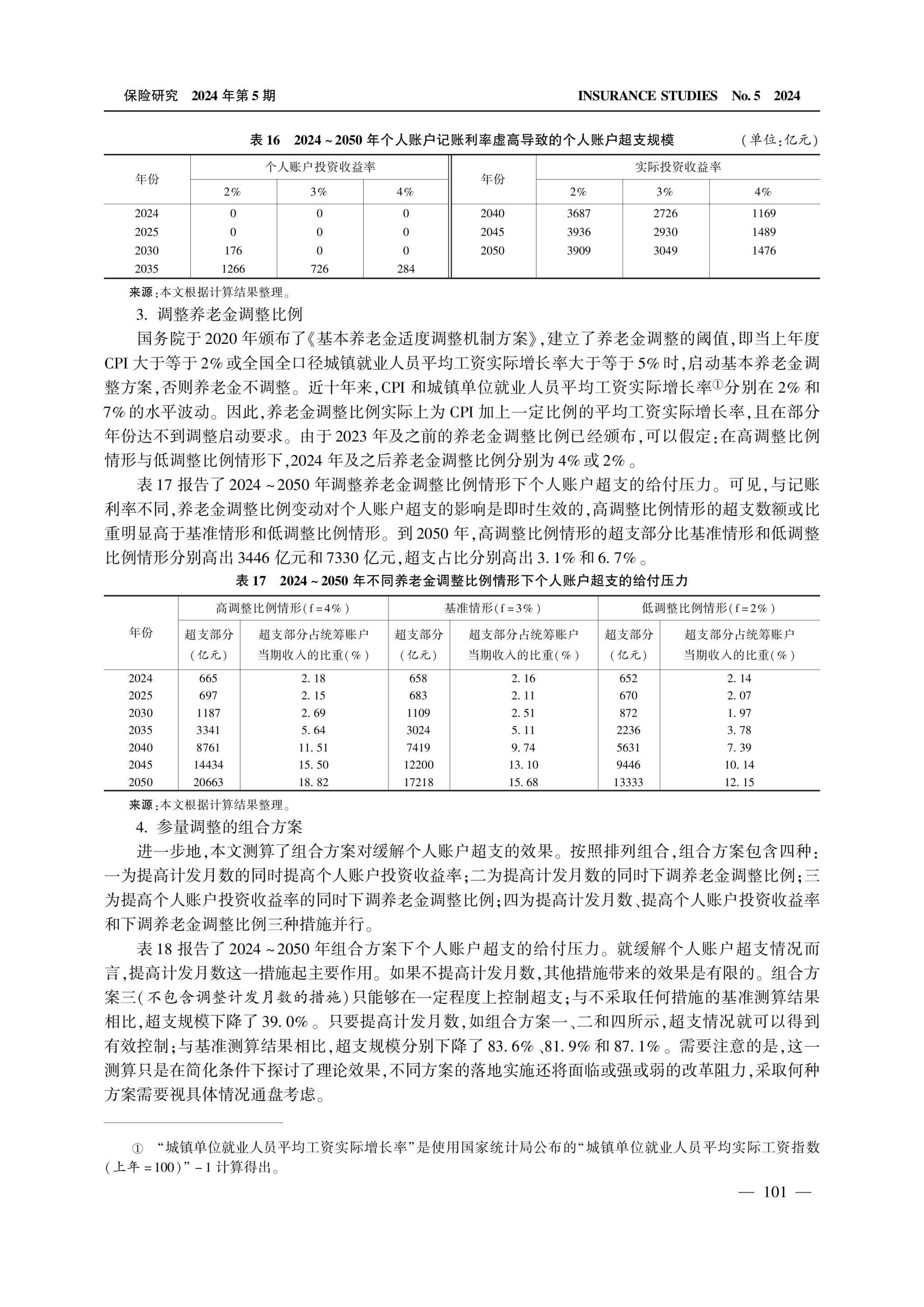

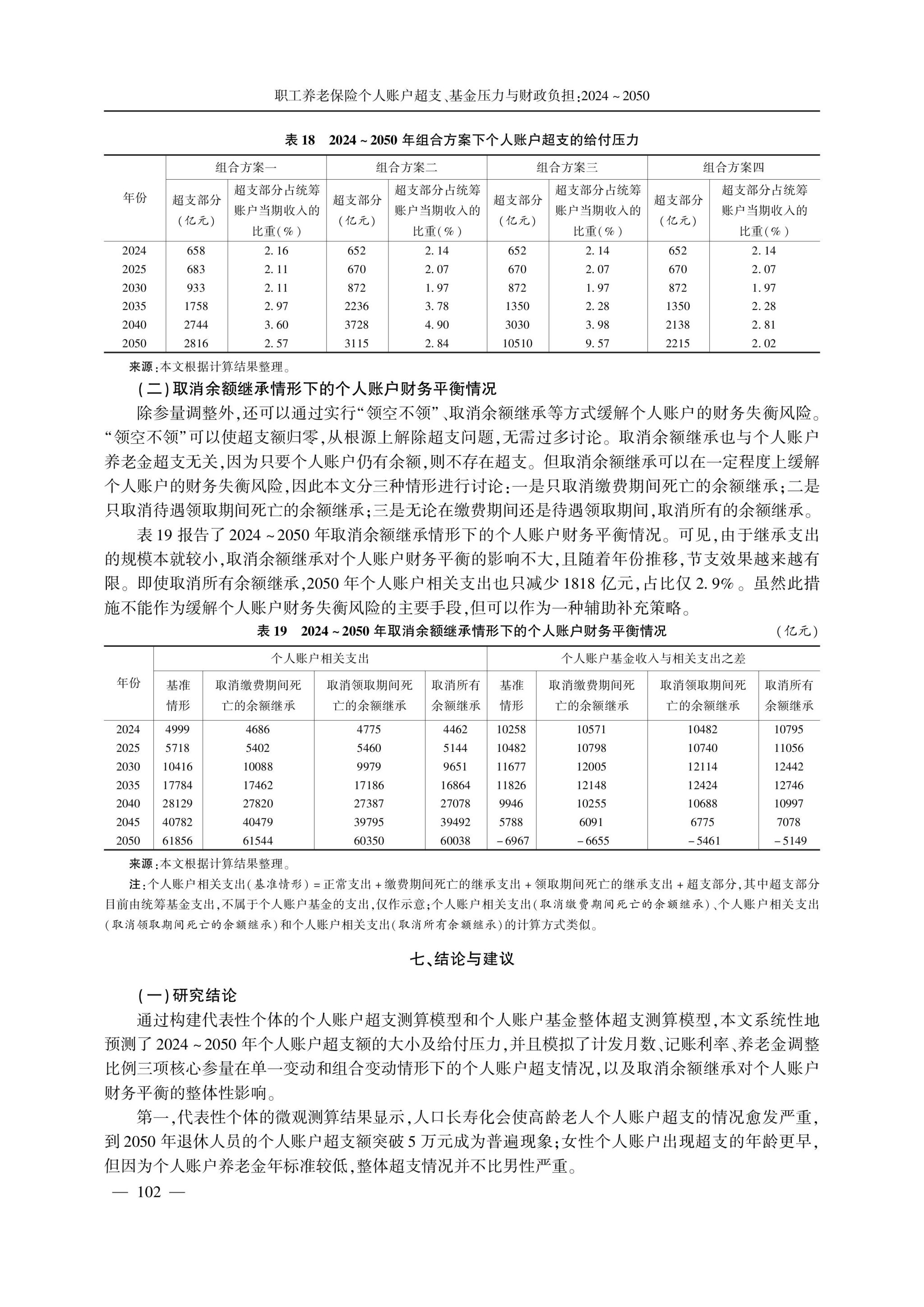

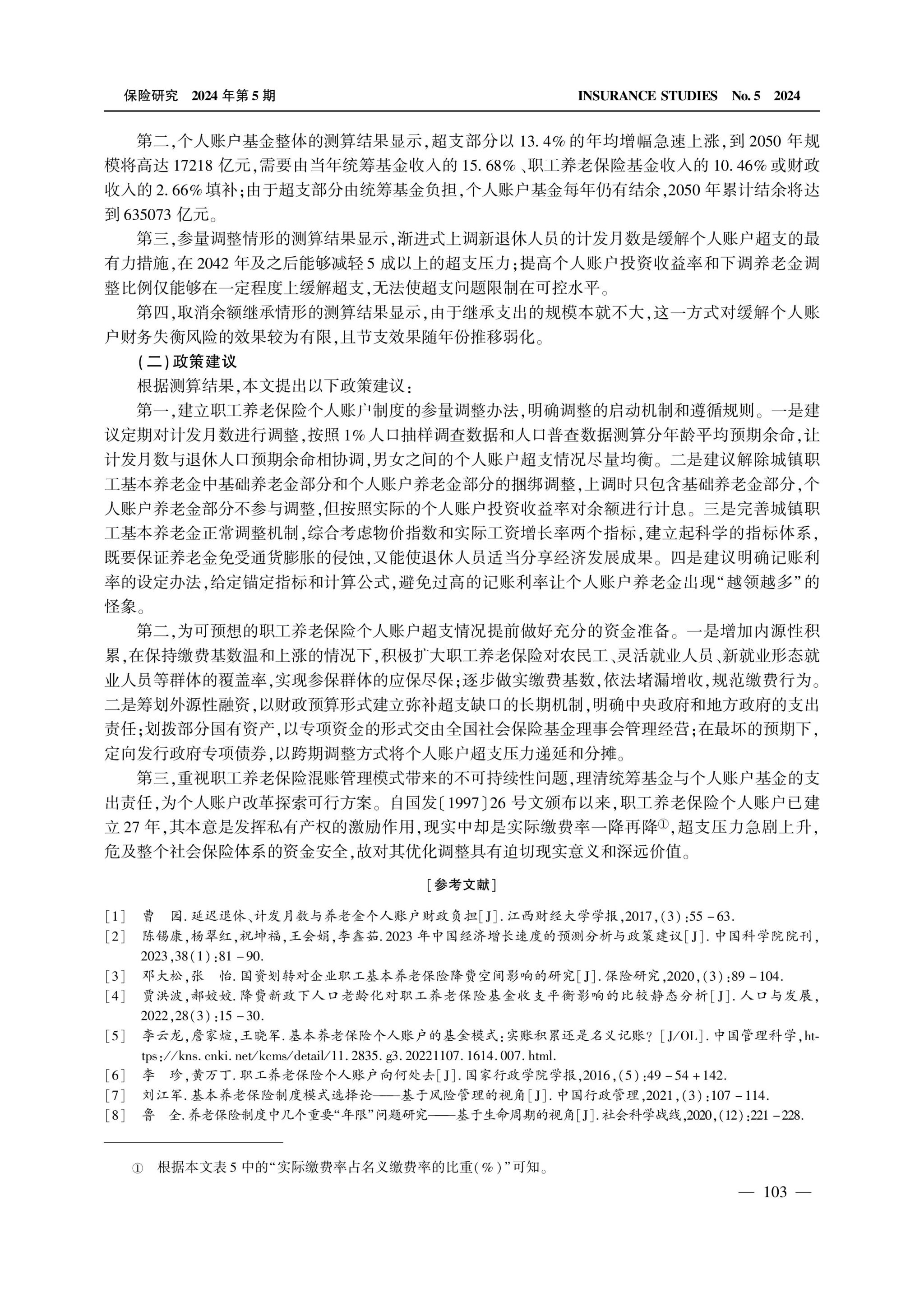

【Abstract】This paper estimates the overspending of personal accounts of various representative individuals in 1998~2050 by constructing the calculation model of personal account overspending of representative individuals and the overall overexpenditure calculation model of personal account funds, and predicts the size of the overall overexpenditure of personal account funds and the payment pressure of personal account funds in 2024~2050. The results show that there is a huge overrun in the personal account of the elderly, and the overall overrun of the personal account fund has risen rapidly with an average annual growth rate of 13.4%, and the scale will be as high as 1,721.8 billion yuan by 2050, which needs to be filled by 15.68% of the overall fund income, 10.46% of the employee pension insurance fund income or 2.66% of the fiscal revenue; The gradual increase in the number of months of new retirees is the most powerful measure to alleviate the overspending of personal accounts, which can reduce the overspending pressure of more than 50% in 2042 and beyond, while increasing the return on investment of personal accounts and reducing the pension adjustment ratio can only alleviate the overspending to a certain extent, and cannot limit the overspending problem to a controllable level. It is recommended accordingly: first, establish a parametric adjustment method for the personal account system, so that the number of months of calculation and payment is coordinated with the expected remaining life of the retired population, cancel the bundled adjustment of the basic pension of urban employees, improve the normal adjustment mechanism of the basic pension of urban employees, and clarify the anchor index and calculation formula of the accounting interest rate; Second, we should start from the two aspects of increasing endogenous accumulation and planning exogenous financing, and make adequate financial preparations in advance for predictable overspending; Third, pay attention to the unsustainable problems brought about by the mixed account management model of employee pension insurance, and explore feasible solutions for the reform of personal accounts.

【Keywords】pension insurance for urban workers; personal account; Overspend; fund stress; financial burden;

【Funds】General Project of the National Social Science Foundation of China, "Research on the Cost-benefit and Incentive Mechanism of Multi-pillar Pension Insurance for Flexible Employees" (23BSH047);

WeChat public account

Sponsor Unit:武汉大学社会保障研究中心 Address:湖北省武汉市武昌区八一路299号 Postal Code:430072 Tel:027-68752238/027-68755887 E-mail:csss@whu.edu.cn