[Interview]Caixin Weekly | After 19 consecutive increases in pensions

Author: Upload Time:2023-09-04 Views: Go Back

Source: Caixin Weekly, Issue 31, 2023 Publication Date: August 07, 2023

By Liu Denghui, Caixin Weekly

"The adjustment will be in place by the end of the month." On July 10, the person in charge of the pension insurance department of a central city received the adjustment (transfer) plan for the basic pension treatment of retirees in 2023 issued by the province and began to study and deploy this year's work. According to the requirements, it is necessary to complete the replacement of funds for the city's urban employee pension insurance participating retirees from January to July.

For the person in charge, this process is already familiar. According to its introduction, after running the adjustment function module of the pension insurance information system, the adjustment situation of each insured object can be revealed. After the partial data is extracted and verified to be correct, the pension transfer amount is reissued to each insured retiree.

Since mid-July, local governments have intensively released plans to adjust the pension benefits of retirees in 2023. Caixin statistics, by the end of July, all provinces in the country had issued a notice. Including this year's overall adjustment of 3.8%, the basic pension benefits have achieved 19 consecutive years of growth. However, from the point of view of the rise, the adjustment ratio continues to decline gradually in recent years.

In the middle of each year, "Can the pension still go up?How much would it going up?" It has become a hot topic for many enrollees and industry professionals. The annual basic pension adjustment is not only related to the retirement life security of more than 100 million urban employees and retirees, but also closely related to macroeconomic development, sustainable pressure on pension insurance funds, and intergenerational equity. "How to adjust, how much to adjust" tests decision-making wisdom.

"The goal of the basic pension is to provide basic living security for retirees, and the goal of treatment adjustment should be based on ensuring the actual purchasing power level of retirees, and on this basis, let retirees properly share the fruits of economic development." An expert who has long studied the basic endowment insurance adjustment mechanism told us that a mature and stable basic endowment insurance system not only needs to achieve financing stability, fund self-balance, appropriate level of security and management service efficiency, but also needs a scientific adjustment mechanism to adapt to social and economic development.

Policy design needs to be gradually improved. Xue Huiyuan, associate professor and deputy director of the Center for Social Security Studies of Wuhan University, suggested that in the future, in the selection of the basis for pension adjustment and the setting of adjustment ratio, various factors such as price increase rate, wage growth rate, economic growth rate, life expectancy, longevity risk, institutional financial revenue and expenditure status, solvency should be fully considered. On the premise of ensuring that the real purchasing power level does not fall, retirees can properly share the fruits of economic and social development while taking into account the solvency of the system.

At the same time, changes in key factors such as population and employment will also constrain future financing, increasing sustainable pressure on pension funds. The accumulation of pension wealth of retired workers still needs to be expanded. A number of pension insurance experts suggested that with the narrowing of the space for the improvement of the first pillar basic pension treatment, it is also necessary to accelerate the promotion of the two or three pillars of enterprise annuity and personal pension in the future, and improve pension security through multiple channels.

The increase rate is slowing down

In May this year, the Ministry of Human Resources and Social Security and the Ministry of Finance jointly issued a document clarifying that the adjustment ratio of the basic pension level of retirees in enterprises, organs and public institutions in 2023 will be determined according to 3.8% of the monthly basic pension per capita of retirees in 2022. Each province determines its own adjustment ratio and level with the national adjustment ratio as the upper limit. Under the pressure of economic downturn and fiscal expenditure, after the release of the increase, all walks of life have different discussions.

In the view of some industry insiders, this increase is basically in line with expectations. The pension insurance experts said that after the 4% adjustment increase was determined last year, many industry people predicted that the adjustment level in 2023 or after may be at 3%-4%, and the final adjustment level is more appropriate. He said that the adjustment of pension benefits is the inherent law and rigid requirements of the operation of the system, which should consider the economic situation, financial situation, sustainable pressure on pensions, etc., but also consider the basic living security of retirees, such as the growth of the CPI (Consumer Price Index), etc., to ensure that the real purchasing power does not fall. "At present, the enterprise employee pension insurance is promoting the national pooling and other parametric reforms, despite the economic downturn and financial pressure, but there is a certain room for adjustment of the system itself." The expert said.

A person familiar with the local adjustment said that it had judged that the overall increase this year was about 3.8%, and the annual adjustment was highly expected by the people, and the current downward trend was fixed, which can only slow down the speed in the short term, and also leave some space for subsequent years. In his view, 3% May be the lower limit for future adjustments, which may stabilize or directly introduce a normal, automated adjustment mechanism, rather than the government departments to announce the adjustment rate every year.

Since 2005, the basic pension has been rising for 19 consecutive years. In the meantime, in order to narrow the pension treatment gap between retirees of government institutions and enterprise units, the basic pension insurance for enterprise employees has maintained a 10% adjustment range for ten consecutive years, and the pension has increased from more than 700 yuan to more than 2,000 yuan in 2015, an increase of three times. The adjustment has also been formally written into the Social Insurance Law, clearly establishing a normal adjustment mechanism for basic pensions, and timely raising the level of basic pension benefits in accordance with the increase in the average salary of employees and rising prices.

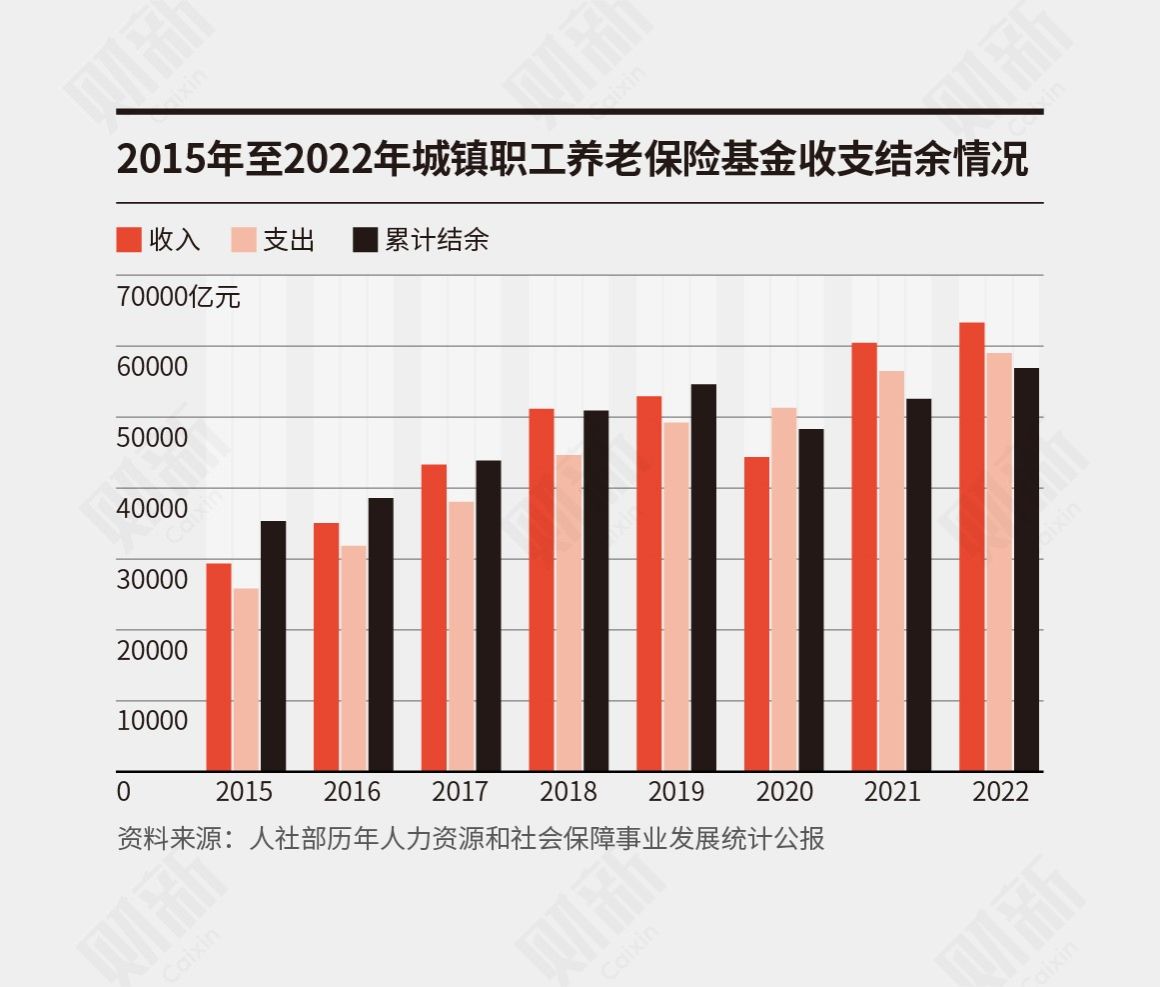

Problems arise. Xue Huiyuan told Caixin that in recent years, the average adjustment of basic pensions for some retirees in China has even exceeded the growth rate of GDP (gross domestic product) and the average wage growth rate of employees, and the adjustment of administrative mandatory pension benefits in China has caused a serious phenomenon of "upside down" pensions for incumbents and retirees, and the pension level of some retirees is too high, exceeding the average salary of employees. It brings great challenges to the fairness of pension treatment and the financial sustainability of the fund. If financial subsidies are deducted, and only the actual fund collection income and fund expenditure are considered, the basic pension insurance for urban workers has been in the current revenue and expenditure gap since 2014, and the scale of the gap has been expanding, and the system has become increasingly dependent on financial subsidies. (The number of pensioners, pension insurance fund revenue and expenditure changes, etc., see "[Data reading] How to balance the increase in pension expenditure pressure?" )

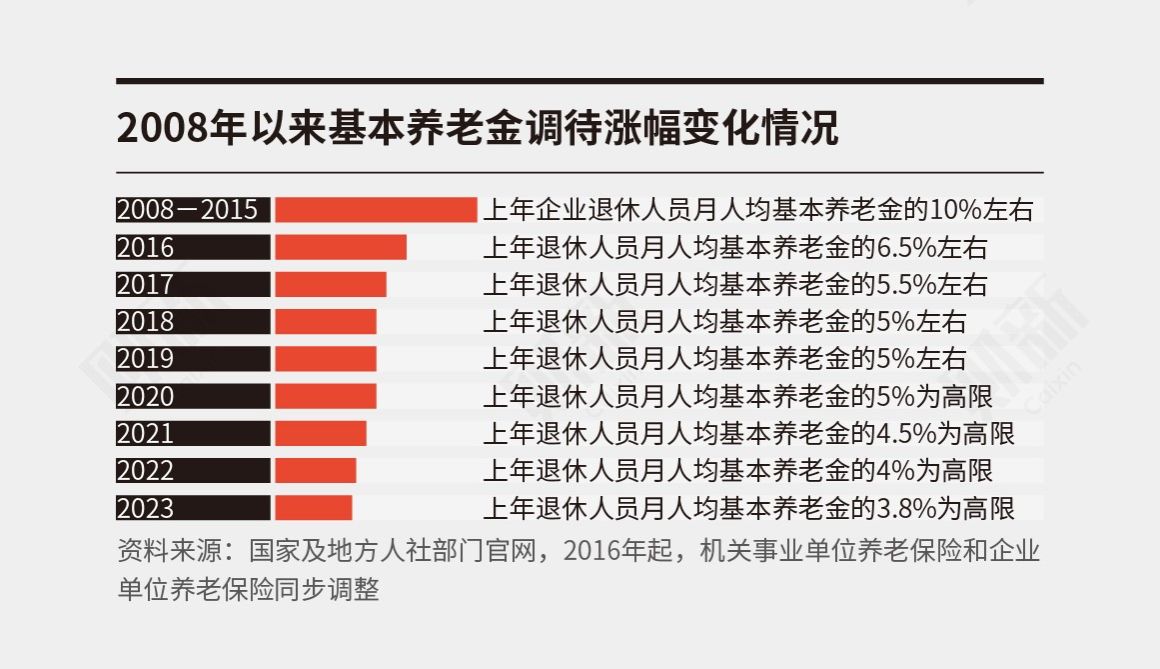

Since 2016, the basic pension adjustment rate has entered a downward cycle, from 10% in 2005-2015 to 6.5% in 2016, 5.5% in 2017, 5% in 2018-2020, 4.5% in 2021, 4% in 2022, and 3.8% in 2023. "This has a lot to do with China's economy entering a new normal, its institutional solvency, its aging population and its financial difficulties due to the epidemic." Xue Huiyuan said.

"The overall adjustment trend is definitely getting lower, but the absolute number is still growing." The person in charge of the central municipal pension insurance department said that although the current adjustment rate has declined relatively, the absolute amount of expenditure has not been reduced after the pension base has increased. For those who have retired, they have to be transferred every year, and the actual treatment continues to improve. At the same time, more and more people enjoy benefits under the background of aging, resulting in increasing pressure on fund expenditure.

The range of local adjustments is different, further widening the regional gap. According to the relevant literature, although the national level makes principle provisions on the adjustment range of pensions every year, the provinces sometimes break through this limit in the actual adjustment. In 2018, for example, the increase rate stipulated by the state was 5.5%, and according to the data published by the National Statistical Yearbook, the national average increase rate in that year actually reached 10.08%, and 15 provinces broke through the prescribed increase rate.

With the promotion of the national pooling of pension insurance, the autonomous authority of local adjustment has shrunk. According to an expert who has long paid attention to the adjustment mechanism, since 2020, the documents of the two departments have clarified that the national adjustment ratio is the high limit of adjustment across the country, rather than "around". As the national pooling has entered a substantive stage, the documents of the two departments in 2022 clearly specify that on the basis of not raising the basic pension level of retirees by themselves and not raising the treatment level in disguised ways such as establishing minimum pension standards, the adjustment of basic pensions of retirees will be newly included in the assessment of the national pooling work of provincial governments' pension insurance. The reduction in fund revenue and increase in fund expenditure caused by local policies introduced on their own will be handled in accordance with the relevant provisions of the national overall planning system after verification.

"A very important content of national coordination is the national coordination of treatment, since 2018, the national coordination has broken the ice from the central adjustment system, and has been substantially promoted by 2022, strengthening the guidance of local governments, and reducing the authority of local adjustment." The experts said.

"Now the overall transfer is still following the requirements of the state, and the proportion assigned by the state will be controlled by the local level." Some people in the industry said that even if the local government has the strength to transfer, it can not break through the national proportion, and long-term sustainability should be considered. Under the current national pooling model, provinces with fund balances need to transfer part of their funds, and before the implementation of the national unified revenue and expenditure model, they need to leave enough space for future payment to avoid future financial burdens.

After the implementation of national co-ordination, will there be more room for adjustment? The above-mentioned people familiar with the local transfer believe that the national pooling has not changed the total amount of funds, and it is difficult to achieve an increase only by this single factor, "in the future, if the national economy is better, there are more job opportunities, the number of on-the-job contributors and the contribution base are high, and the pension balance is better, there should be room for an increase."

However, after the implementation of national pooling, the issue of transfer may become more complicated. The person in charge of the pension insurance in the central region said that different regions have different levels of development and different pension treatment bases. "Simply averaging is bound to create new problems, which is a big issue."

How much pressure is there

Of particular concern is that behind the 19 years of continuous growth, the basic pension and financial pressure as a source of expenditure. According to the documents of the two departments, the funds needed to adjust the basic pension shall be paid from the enterprise basic pension fund for those who participate in the basic pension insurance for enterprise employees, and from the basic pension fund for those who participate in the basic pension insurance for employees of government organs and public institutions.

Data from the Ministry of Human Resources and Social Security show that in 2022, the annual income of the basic pension insurance fund for urban employees will be 6,332.4 trillion yuan, and the expenditure will be 5,903.5 trillion yuan, with a cumulative balance of 5,689 billion yuan at the end of the year. However, the system is highly dependent on financial subsidies. Demand for pensions is rising rapidly as the population ages, especially the baby boomers born after 1962. According to the "China Pension Actuarial Report 2019-2050" forecast, in the absence of delayed retirement, pension income will peak in 2027, income will not exceed the expenditure in 2028, and the fund will be exhausted in 2035.

"China's basic pension can be paid for 14 months at most, but by the end of 2021, the first-pillar basic pension insurance fund for urban workers will only cover 0.9 years." Not long ago, Zheng Bingwen, director of the World Social Security Research Center of the Chinese Academy of Social Sciences, said in an interview with Caixin that in the face of an aging population, China's pension system will not be able to meet the income is an inevitable trend. The "China Pension Actuarial Report 2019-2050" predicts that the simple sum of the current value of the annual revenue and expenditure gap between 2035 and 2050 will be as high as 87 trillion yuan. In other words, by 2050, pension expenditure will account for 8.9% of GDP, which will be higher than a dozen countries such as the United States and the United Kingdom, and the serious imbalance between large GDP countries and small pension countries should be completely changed and reversed as soon as possible.

Based on the realistic assessment, the pension is adjusted according to the current pace and can still be maintained for a certain period of time. The person familiar with the local transfer said that the current basic pension still has trillions of yuan of accumulated balance funds, and after the national pooling of enterprise employee pension insurance, the nationwide pension fund pool can effectively guarantee the transfer of expenses. At the beginning of the year, some local budgets tend to increase in accordance with the higher rate of the previous year, and the actual increase is lower than the budget, and the pressure is not great. "Even after the transfer in July, the funds were in place in January."

Under the background of population aging, there will be fewer and fewer contributors in the future, and the intergenerational equity of pension payment needs attention. The person in charge of the central municipal pension insurance department indicated that although there is a certain balance in the current basic pension insurance, it is partly a "liability" for young people, and will face the pressure of repayment after their retirement. From the perspective of fairness, finance should play a role in the transfer of funds.

In fact, the documents of the two departments have made it clear that the central government will provide appropriate subsidies for the funds needed by the central and western regions, the old industrial bases, the Xinjiang Production and Construction Corps, and the central state organs in Beijing and their affiliated public institutions. Local governments shall provide certain subsidies to the newly allocated funds for the basic pension of retirees from local adjustment enterprises. In addition, some provinces disclosed that in accordance with the requirements of national pooling responsibility sharing of pension insurance, local finance needs to bear 5% of the new expenditure of basic pension adjustment for enterprise retirees, and the pension adjustment subsidy funds of the current year are included in the local financial subsidy base of the next year. Starting from 2022, many places have implemented this requirement.

The above-mentioned industry sources said that all localities arrange financial budget subsidies in accordance with the 5% of the absolute amount of local personnel to be transferred. Because the policy has just been implemented from 2022, the actual expenditure scale is relatively limited at present.

"Generally speaking, the current burden is not heavy, and local governments only took the 5% of the transfer last year." For less developed regions, there may be financial pressures. However, the annual base of the transfer is accumulating, and the further it is rolled back, the greater the pressure on local finances." 'he said.

The person said that the basic pension balance fund in the economically developed provinces is still considerable. At present, the national overall planning has not yet achieved unified revenue and expenditure, but according to the scale of the total deficit of the national fund for the current period, the provinces with surplus revenue and expenditure will settle the funds, and the central government will allocate the funds to the provinces with gaps in current revenue and expenditure. The scale of the current gap is not too large. Even if the provinces with fund balance settle part of the funds, the local governments will still have a certain surplus, and they can continue to guarantee the adjustment for a certain period. Even at the national level, the provinces with revenue and expenditure gaps can be resolved, and the overall fund revenue and expenditure is still surplus, which can maintain pension payments, and further actuarial calculation is needed.

Compared with the pension insurance of enterprise employees, the basic pension insurance fund of government and public institutions is more dependent on finance. The person in charge of the central municipal pension insurance department said that the current government agencies and institutions and enterprise employees and retirees are being transferred, but the basic pension insurance of government agencies and institutions is due to the late establishment of the system, the proportion of active personnel is lower than that of enterprise units, and the accumulation of historical balance is limited, and many regions need to rely on financial subsidies, which increases the local financial pressure that is already difficult.

Make expectations clear

Under the slowdown of the increase, how to give the people a clear expectation of adjustment is more critical.

"After adjusting according to provincial policies every year, the people must have an intuitive feeling that the proportion of adjustment is getting smaller and smaller." The above-mentioned industry sources said that the government departments to carry out a large number of policy propaganda, to explain to the people that the country itself is also doing its best, and organs and institutions and enterprise units of retirees are the same standard, the people can understand, the overall can be smooth transition. "But if this trend continues, ordinary people will wonder if the adjustment will be reversed, or even lower."

Since 2005, the domestic adjustment has basically formed the practice of one adjustment every year and continuous growth, and the human resources and social affairs department and the financial department have jointly issued a document to determine the overall adjustment ratio of the year. The aforementioned pension insurance experts believe that the current industry in the adjustment method, adjustment time, adjustment object, adjustment range, adjustment method and adjustment of funds to be arranged at the level of understanding basically reached agreement, in the adjustment range of comprehensive consideration of adequacy, sharing and fund support capacity, factors considered include the level of economic development, price level, wage growth rate and fund support capacity.

As for the adjustment methods, the framework of quota adjustment, peg adjustment and tilt adjustment has been basically formed. Quota adjustment is implemented to increase the same amount of pensions for all types of retirees in the overall planning area, reflecting the principle of fairness, and local areas often increase tens of yuan. Linked adjustment of the implementation of pension and the contribution period, the level of the basic pension of the previous year, play the incentive role of "pay more, pay more for a long time", and appropriately reflect the inclined care for special groups, accounting for a small proportion, to avoid the "one-size-fits-all" pension treatment adjustment.

For example, in Shanghai, the quota adjustment in 2023 will increase by 61 yuan per person, and the linked adjustment will increase by 1 yuan per month for each full year according to my contribution years, and at the same time, it will increase by 1.8% per month according to the basic pension received by me in December 2022. At the tilt adjustment level, it is a monthly increase of 25 yuan, 35 yuan and 45 yuan per person for those who are 70, 75 and 80 years old before the end of 2022.

In the implementation of specific policies, the above-mentioned people familiar with the local transfer said that the human and social departments and financial departments will determine the overall adjustment ratio every year, and will also clarify the upper and lower limits of the specific transfer, and require the average increase of the transfer of retirees in enterprise units to be higher than the average increase of the transfer of organs and public institutions. In order to make the difference between the actual growth of government organs and public institutions and enterprise units smaller and smaller. Specifically, it is necessary to calculate the parameters and determine the respective average increase according to the number of retirees in provincial organs, institutions and enterprises and the average payment period, with reference to the previous year's adjustment amount. In addition, it is necessary to ensure that the final overall adjustment ratio does not exceed the national standard. Finally submitted to the local government and the Ministry of Human Resources and Social Security approval after implementation.

The person said that in recent years, the overall adjustment ratio of the country has entered a downward cycle, and the tilt adjustment of the elderly group is rarely changed in the adjustment, and the quota adjustment is basically reduced and the linked adjustment part. "Under the conditions that the average adjustment range of enterprise retirees is higher than that of government agencies and public institutions, while the enterprise units are not higher than the upper limit, the public institutions are not lower than the lower limit, and the overall ratio should reach 3.8%, the actual adjustment space of the local authorities is very small."

Some voices believe that among the three adjustment methods, the future can be appropriately tilted to the hook adjustment part. In the documents of the two departments, it is also stressed that incentives should be further strengthened and the proportion of linked adjustments should be appropriately increased. The person in charge of the central municipal pension insurance department said that when retirees calculate their initial pension benefits, the amount they receive is related to the length of the payment period and the level of the payment base, and the longer they pay and the higher the payment base, the more pensions they receive. After retirement, the effect of this system incentive should also be reflected to improve the enthusiasm of participating in insurance. In his view, the proportion of funds transferred through the adjustment of the link should be at least 50%-60%.

However, there are some difficulties in reality. The person familiar with the local transfer said that if you start from the insurance concept, you should encourage more to pay more and pay more for a long time. In practice, due to the lower insurance contribution base in reality, there is a large gap between the actual pension treatment of enterprise and public institution retirees. If the proportion of linkage adjustment is too high, it will continue to widen the treatment gap between different groups. In contrast, the high proportion of quota adjustment is more conducive to the improvement of the treatment of retirees in enterprise units, and the reality must be considered. For example, in some localities, quota accounts for about 40% of the funds to be transferred, while peg adjustment and tilt adjustment account for more than 30% and 20% respectively.

There are also voices that the current adjustment of social planning and personal account pension is unified, and the system boundary is blurred. Xue Huiyuan suggested that the practice of basic pension insurance for urban and rural residents can be used for reference, and retired employees will only increase the basic pension and not adjust the personal account pension when the pension is transferred. "Individual accounts belong to individual property rights and are actuarially balanced. Mixing the basic pension and the personal account pension and raising it goes against the principle of actuarial balance and fairness."

What is more important is to give the public transparent and stable expectations than specific adjustment details. Some voices believe that although the current adjustment mechanism is becoming more and more scientific, emphasizing that it is linked to comprehensive factors such as economic growth, wage growth rate, CPI, and fund sustainability, the actual degree and proportion of the linkage have not been announced, and the overall administrative adjustment is still relatively high.

Over the years, many voices in the academic community have called for learning from international experience and building a scientific and reasonable automatic adjustment mechanism. For example, relevant literature by Lin Yi, director of the Aging and Social Security Research Center of Southwestern University of Finance and Economics, and others show that Sweden introduced an automatic balancing mechanism in 2001 to adjust the pension benefits of nominal accounts through a complete "appraise - trigger - adjust - reevaluate" mechanism. The mechanism uses the balance ratio, which reflects the pension fund's assets and liabilities, as the trigger parameter. When the balance ratio is greater than or equal to 1, the pension is in a state of financial balance, and the pension benefits are adjusted according to the average wage growth rate. When the balance ratio is less than 1, it means that the liabilities of the pension fund exceed the assets, the automatic balance mechanism is activated, and the recording interest rate of the nominal account will be reduced. Other countries have similar practices.

It is understood that in the early years, the human and social security department has also sought opinions related to the automatic adjustment mechanism. Local authorities can adjust according to the adjustment formula combined with local published data, without the approval of the Ministry of Human Resources and Social Security and the Ministry of Finance, but because the time is not ripe to continue to promote.

The aforementioned experts who have long paid attention to the adjustment mechanism said that the setting of the calculation formula of the automatic adjustment mechanism is very complicated, and the current academic discussion is more focused on the theoretical level, calling for the inclusion of factors such as demographic structure changes and fund sustainability, but how to set the weight of various factors, and how to properly arrange the "old people", "people" and "new people" of the system reform, there are still big problems in practice.

In order to stabilize social expectations, the aforementioned pension insurance experts suggest that in the future, specific plans or rules of the pension treatment adjustment mechanism can be incorporated into relevant laws and regulations such as the Social Insurance Law, so as to legalize the sharing of the fruits of economic development among retirees and ensure the stable security expectations of retirees. At the same time, it is also possible to consider setting indicators within the system to adapt to external macroeconomic changes and demographic changes, including indicators such as the system support rate and fund payment capacity into the reference base of pension benefit adjustment, and improve the adaptability of the system to the external environment.

Replacement rates remain low

Pension is related to the pension security of retirees, all walks of life are highly concerned about the basic pension transfer behind, the core is the weak development of the two and three pillars in China, the basic pension is a dominant, so that the replacement rate of the entire pension system is basically equivalent to the replacement rate of the basic pension.

The so-called replacement rate is an important indicator to measure the living standard of workers after retirement. Xue Huiyuan introduced that if the average replacement rate is measured, that is, the ratio of the average monthly pension of all retired employees to the average monthly salary of employees in the previous year, according to the data of the Statistical Bulletin on the Development of Human resources and Social Security Undertakings, the average replacement rate of the first pillar in 2021 will be about 48.2%. The International Labor Organization considers 55% to be the international warning line of the pension replacement rate, if it is lower than this value, the standard of living of retirees will be seriously reduced; The World Bank recommends that the replacement rate for retirement needs to be no less than 70% to maintain pre-retirement living standards.

"From the current average replacement rate of the first pillar employee pension insurance, there is still a certain gap between the low pension level in China and the demand for decent pension." Xue Huiyuan said that since the adjustment of the benefits of enterprise retirees for 19 consecutive years, the per capita pension level has increased from 700 yuan per person/month in 2005 to 2,987 yuan/month in 2021, and it is estimated that it will increase to 3,225 yuan/month in 2023. However, in recent years, the average replacement rate of basic pension has shown a downward trend, mainly because the pension increase rate is lower than the wage growth rate in recent years, and the numerator growth rate is lower than the denominator growth rate.

In fact, pension transfers are not the key to boosting the replacement rate. Xue Huiyuan explained that the original intention of the transfer is to ensure that the purchasing power of the basic pension for retirees will not fall due to rising prices, and to allow retired elderly people to properly share the fruits of economic development. According to this concept, the adjustment ratio of the basic pension should be greater than or equal to the inflation rate, and less than the economic growth rate. If the adjustment ratio exceeds the economic growth rate, it will become a drag on economic development and hinder economic development. In 2023, the monthly per capita basic pension adjustment ratio of retirees has dropped to 3.8%, and it will continue to decline in the future, and it is unrealistic to expect that the replacement rate can be improved through adjustment.

In contrast, he suggested that by encouraging employees to pay longer and more pension premiums, such as raising the minimum contribution period of employees' pension insurance (currently 15 years), which is currently included in the "14th Five-Year Plan" for the development of human resources and Social security undertakings. Secondly, strengthen the investment operation of the basic pension insurance fund and improve the return rate of individual accounts. At the same time, the policy of gradually raising the statutory retirement age will be implemented as soon as possible. After delayed retirement, the contribution period will increase, the number of months of personal account payment will become smaller, and the basic pension and personal account pension will be greatly increased, which can improve the replacement rate of the first pillar.

It can not be ignored that under the current basic pension insurance positioning, the space to continue to improve the replacement rate is relatively limited, and it is urgent to expand other sources such as the second and third pillars. The person in charge of the central municipal pension insurance department said that one pillar continues to increase the replacement rate, and the basic pension and financial expenditure are under great pressure. If the replacement rate of one pillar is too high, it will directly affect the development scale of the two and three pillars. From the perspective of improving pension treatment, the future should be multi-channel and multi-pillar development.

"At present, most people are still mainly concerned about the basic pension, and the country is actively promoting the development of the two and three pillars. If the two and three pillars can stand firm in the future, the basic pension will no longer be overly concerned." The person familiar with the local transfer said.

Judging from the data, the current domestic development of the second and third pillars is still very weak. Data from the Ministry of Human Resources and Social Security show that the accumulated balance of the basic pension insurance fund for urban workers will reach 5.689 billion yuan by the end of 2022. In contrast, the operation scale of enterprise annuity investment at the end of the year was 2.87 trillion yuan, and only 12800 enterprises in the country had established enterprise annuity, with 30.1 million employees participating, less than one tenth of the 444 million employees participating in enterprise employee pension insurance. As of the end of June, 40.3 million people had opened personal pension accounts in 36 leading cities (regions) across the country, but the number and amount of contributions were very small.

Some voices suggest that the scale of basic pension insurance can be reasonably controlled to leave room for two or three pillars. The aforementioned experts who have been paying attention to the transfer mechanism for a long time said that in the current proportion of basic pension financing, enterprises (16%) and individuals (8%) pay a total of 24%, although the previous 28% has decreased, but after enterprises and individuals pay other guarantees such as medical insurance and provident fund, it is difficult to pay the two or three pillars. We may consider further reducing the proportion of funding for some basic pensions to leave room for the development of the second and third pillars. At the same time, we should further improve the capital market of pension investment, enrich investment products, and increase the return rate of enterprise annuity investment.

Xue Huiyuan suggested that the entry threshold of enterprise annuity should be further reduced, the enterprise annuity collection plan should be fully promoted, the automatic accession mechanism should be implemented, and the coverage of the system should be expanded. At the same time, preferential tax policies can be further improved, the scope of tax incentives should be expanded, and the proportion of pre-tax deduction of enterprise annuity contributions should be appropriately increased, and it is proposed to increase to 8% of the total salary of the enterprise employees.

As for the third pillar of personal pensions, which has attracted much attention, its appeal to all groups needs to be improved. Xue Huiyuan said that low-income workers and urban and rural residents themselves have low incomes, and the willingness to deduct a certain amount of participation each month may not be high, and low-income people who have not reached the personal income tax threshold (monthly income less than 5,000 yuan) to participate in the third pillar not only enjoy no tax incentives in the payment link, but also pay personal income tax at the rate of 3% when receiving the link, and the willingness to participate is less strong; For high-income groups, the third pillar tax incentives are smaller, calculated according to the annual payment limit of 12,000 yuan, and the annual payment link can only enjoy a maximum of 5,400 yuan of personal tax incentives.

"The upper limit of personal pension contributions is still a little low, and the impact on future pension security is too small." Now just launched, there are not many financial products to choose, many people participate in tax participation, become the nature of deposit, did not play the role of buying financial products ", the above-mentioned familiar with the local transfer said that the current personal pension is being piloted, the future policy after the national release, can gradually increase the pension ceiling, at the same time, can also explore "live in live out", The formation of a large national pool of funds to avoid only receiving after retirement affects the willingness to participate.

The supply side of the product also needs continuous improvement. Zheng Bingwen said that the sustainability of the third pillar pension insurance lies in product advantages and product research and development. If there are problems with "qualified" products, either the return on investment is too low, or the product is single and homogenized seriously, the investment purchase of the third pillar pension account holders will have no enthusiasm, which will seriously affect the sustainable development of the third pillar personal pension.

"In fact, the difficulty in developing the second and third pillar pension insurance in China is not the lack of sales channels, but the current system design can not meet the various needs of the industry and the market, and it is difficult to stimulate and trigger this potential market, which also leads to no interest in pension products after they hit the shelves." Zheng Bingwen said.

Zhou Dongxu contributed to this article

WeChat public account

Sponsor Unit:武汉大学社会保障研究中心 Address:湖北省武汉市武昌区八一路299号 Postal Code:430072 Tel:027-68752238/027-68755887 E-mail:csss@whu.edu.cn